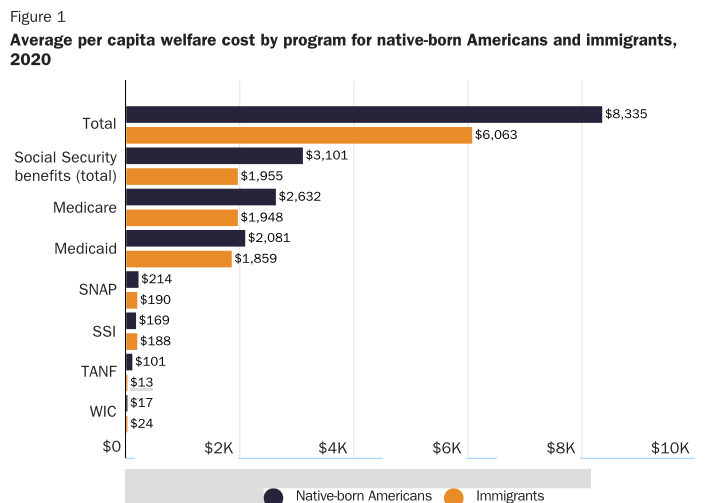

The average value of welfare benefits per immigrant was $6,063 in 2020, or 27.3 percent less than the $8,335 average for native‐born Americans. Figure 1 breaks down the numbers by type of welfare program. Immigrants consumed 36.9 percent less Social Security, 26 percent less Medicare, 10.7 percent less Medicaid, 11.5 percent less SNAP benefits, and 87.6 percent less TANF benefits than native‐born Americans on a per capita basis. However, immigrants consumed 11.4 percent more in SSI benefits than natives, which translates to $19 more than natives on a per capita basis. Immigrants individually also consumed 42.9 percent more WIC benefits than native‐born Americans, which translates to $7 more than natives per capita.

This is from Alex Nowrasteh, “Immigrants Use Less Welfare Than Native-Born Americans,” Cato at Liberty, February 1, 2023. It’s based on this longer study: Alex Nowrasteh and Michael Howard, “Immigrant and Native Consumption of Means-Tested Welfare and Entitlement Benefits in 2020,” Briefing Paper No. 148, January 31, 2023.

Nowrasteh is aware that 2020 was an unusual year because of the huge (hopefully temporary) expansion of the welfare state by a bipartisan Congress and and President Trump.

One thing these numbers reflect is that the biggest programs in the welfare state are Social Security and Medicare. A lot of immigrants have not been here long enough and/or have not earned high enough income (and paid the related FICA taxes) that they qualify for high Social Security payments. But Nowrasteh is aware of that and strips out Social Security and Medicare. He writes:

Immigrants still consumed less than natives when the entitlement programs of Social Security and Medicare are excluded from the analysis. The average immigrant consumed $2,273 in means‐tested welfare benefits in 2020, about $310 less than the average American who consumed $2,583. That’s a difference of 12 percent.

As you can see, that narrows the difference substantially. So an immediate question to ask is whether immigrants pay their own way. Do they, as a whole, pay enough in taxes to make up for the welfare expenditures on them? Nowrasteh is aware that he hasn’t answered that question, writing:

Evaluating the net‐fiscal effects of immigration – whether the taxes paid due to them being here is greater than their consumption of benefits – requires more complicated calculations and estimates. Stay tuned for those.

Whereas some advocates of allowing much more immigration have no problem with the welfare state, Nowrasteh isn’t in that category. He writes:

Elderly immigrants consume more Medicaid benefits than elderly native‐born Americans, but natives are more expensive than immigrants in the same age groups on a per capita basis for all other large programs and most smaller ones. Immigrants are already legally restricted from accessing most welfare programs for some years after their arrival, but minor legal changes along the lines we suggest here would significantly reduce immigrant access to all these programs. Rep. Grothman (R‑WI) has introduced multiple bills to end welfare access to non‐citizens, which is second best to massively scaling back welfare for all.

Note also his discussion of how immigration to Israel increased the welfare state in the short run and reduced it in the long run.

Disclosure: I’m an immigrant who had a fairly bad experience on my first try at getting a green card. That probably biases me.

READER COMMENTS

Loquitur Veritatem

Feb 2 2023 at 10:43am

So what? The total cost of welfare rises with the number of immigrants. I venture to say that the average immigrant pays far less in taxes than the average native-born taxpayer. Which means that immigration causes the average native-born taxpayer to pay more taxes than he would have absent immigration.

john hare

Feb 2 2023 at 11:57am

Immigrants in my company earn well above the local average and pay more in taxes. My wife is an immigrant from Mexico and at family functions it seems all the men and most of the women have jobs and pay taxes.

Thomas Lee Hutcheson

Feb 3 2023 at 3:48pm

The question ought to be not taxes paid but economic value created by the marginal immigrant the next one or one million that we might decide to recruit or not.

Jon Murphy

Feb 5 2023 at 10:23am

I don’t think your conclusion follows from the premise. Whether immigrants pay higher or lower taxes compared to native citizens doesn’t seem like the relevant comparison. The relevant comparison would be immigrant taxes to their welfare payments. For example, if the two (taxes paid and welfare recieved) equal, I cannot think of why the native would have to pay more taxes. In that case, the situation would be neutral

nobody.really

Feb 6 2023 at 4:57pm

Sounds right to me.

Truer words were never written. Literally.

TMC

Feb 2 2023 at 10:54am

As a son of two immigrants, I also am biased for immigration. I support more than we allow now, but none of today’s illegal immigration. Maybe a model closer to Canada or Australia’s.

When my parents came here the US made certain the immigrant had the job skills or the means to take care of themselves, but the process seemed easier.

David, I’m glad you waited out the process – our gain for sure.

Mark Brophy

Feb 2 2023 at 1:14pm

David, Neil Young, and many others emigrated from Canada and had a difficult time coping with our government. We should give Canadians special treatment because they’re rich, speak English as a first language, and come from an adjacent country. Computer programmers in Vancouver living a poor quality life should be able to move to Seattle easily because we can profit from them.

Richard W Fulmer

Feb 2 2023 at 1:45pm

Is the money needed to house and feed undocumented immigrants and asylum seekers included in Mr. Nowrasteh’s definition of welfare? If not, does that significantly change the numbers?

Thomas Lee Hutcheson

Feb 2 2023 at 4:36pm

Of course we should be looking at marginal not average immigrants. The policy issue ought out be by how much should we increases highly skilled, educated, entrepreneurial immigrants.

And not all of the “surplus value” from an immigrant’s work is collected in taxes. That would be like analyzing the gains from relaxing a quota on a tariffed imported good and counting only the increased tariff revenue as the gain.

Johnson85

Feb 3 2023 at 10:43am

This seems like an answer to a question nobody is really worried about.

I think very few people think our current levels of legal immigration are too high, but I think this article might convince some people it is, or at least not selective enough. I think most people would want the welfare usage by legal immigrants to be much lower than that of natural born citizens (and probably a significant number of people would argue the number should be approaching zero if not zero).

I think people would want to know how much welfare illegal immigrants use, and probably even more so, how much their children use on average.

I think we should have even low skilled immigration but I do worry that our de facto policy of relatively restrictive immigration unless you want to jump the border from the south is extremely stupid and we should make it easier for high skilled immigrants and probably a little harder for low skilled immigrants.

Comments are closed.