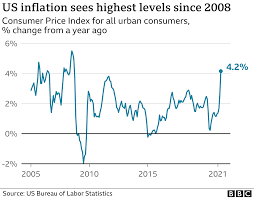

With the recent report that the Consumer Price Index (CPI) rose by 4.2 percent in the twelve-month period from April 2020 to April 2021, many people have started to worry that worse is to come. Many have used the feared C-word: Carter. Recall that during the Carter administration, in the forty-eight months between his inauguration on January 20, 1977, and Ronald Reagan’s inauguration on January 20, 1981, inflation measured by the CPI averaged 10.4 percent annually. There are lags, of course: Carter can hardly be blamed for the first few months of inflation in 1977, just as Reagan can hardly be blamed for the first few months of inflation in 1981. Still, the 10.4 percent estimate gives a reasonable take on Carter-era inflation. Running the numbers from June 1977 to June 1981 gives a similar average annual inflation rate: 10.5 percent.

Is the fear of Carter-era inflation justified? Is the increase in gasoline prices a sign of higher inflation? Is the fear of hyperinflation justified? With President Biden implementing and proposing various policies that will hurt economic growth, is there much danger in the short run of a return to stagflation? My answers: somewhat, no, no, and no.

These are the opening two paragraphs of “Inflation: True and False,” my latest article at Defining Ideas, May 20, 2021.

On Hyperinflation

Some observers have suggested that we should fear hyperinflation. They have no idea what hyperinflation is. Hyperinflation is not just high inflation. Hyperinflation is inflation of 50 percent per month or more. The most extreme hyperinflations in history were in Germany from 1921 to 1923, Hungary from August 1945 to July 1946, and Zimbabwe from March 2007 to November 2008. We’re not even close to 1 percent per month, let alone 50 percent per month. The United States did have extremely high inflation during the Revolutionary War—have you ever heard the expression “not worth a Continental”?—and in the Confederacy during the Civil War. Other than that, the highest US inflation rate in our history was in 1918, when the government used the newly created Federal Reserve to fund its participation in World War I. Even then, the price level between April 1917, when America entered the war, and November 1918, when the war ended, increased by 27 percent. That’s 16.3 percent on an annual basis. Bad? Yes. But hyperinflation? Still not close.

On Stagflation

Why am I so confident? Because we are set to have very high growth in real GDP this year. The reason is not that President Biden’s economic policies are so good. They’re actually pretty bad. The $300 federal addition to the weekly unemployment benefit, which was part of his $1.9 trillion bill in March, will actually cause real GDP to grow more slowly than otherwise because it discourages millions of lower-wage people from taking jobs. My criticism is not partisan. I criticized a similar, though worse, plan after President Trump, back in March 2020, signed the CARES Act, which added a whopping $600 per week to weekly unemployment benefits. That’s the nice thing about economics: we can talk about effects of policies without knowing whether the initiator of the bad policies has an R or a D after his name.

Still, even with this growth-destroying policy, with possibly more to come, real GDP will rise a lot this year. To see why, imagine a hose hooked to a water spigot with the spigot turned on but an elephant standing on the hose. Not much water comes out the other end. But if the elephant gets off the hose, then, even if the water spigot is turned down slightly, a lot of water will come out the other end.

Governments are that elephant. The federal government, to some extent, but mainly the majority of state governments are standing with various weights on that hose by enforcing lockdowns. Once they get off, real GDP will increase.

My prediction: we will have at least 4 percent inflation during the next twelve months and real GDP growth of at least 5 percent on an annualized basis. If the feds get off the hose in September by not renewing the $300 per month federal addition to unemployment benefits, we will have even higher growth.

Read the whole thing, especially if you want me to reply to your comments.

READER COMMENTS

Jerry Brown

May 21 2021 at 5:55pm

Well I read the whole thing so you don’t have to feel bad responding to this if you want to. You were doing so well with the non-partisan analysis and then you had to pick an elephant to stand on the hose. I am outraged on behalf of my Republican friends that you would pick this obviously partisan animal to be an example of impeding the progress of the economy. Why couldn’t it be a hippopotamus on the hose? Hippopotumusses are big and heavy plus it is a fun word to try and write even though my spell check says I’m doing it wrong. And everybody always talks about elephants and hardly ever about hippopotamusses.

John Hall

May 21 2021 at 6:32pm

Typo:

Even then, the price level between April 1917, when America entered the war, and November 2018, when the war ended, increased by 27 percent.

David Henderson

May 21 2021 at 7:44pm

What’s the typo?

BC

May 21 2021 at 7:54pm

“November 2018” should be “November 1918”.

David Henderson

May 21 2021 at 8:02pm

OMG! Thanks.

Michael Rulle

May 25 2021 at 12:58pm

I usually go the other way—e.g., I call 2018 —1918. That is far worse. I prefer your mistake—-biased toward the present!

As a follower of your colleague, Prof Sumner, 4% for next 12 months should be viewed as a fail——although not a “disaster”. One caveat, even with AIT, Powell has not really described how he views both range and time frame to get his 2% average, nor how fast to get there once it has been below—and vice versa. I think that should matter—or even if he is counting last 5 years plus as part of the calculation.

In any event, I believe April CPI was 3% ex food and energy. Powell’s benchmark is PCE ex-food and energy. I had not realized CPI is a month earlier than PCE—-or so it appears. He also warned it would CPI would ‘appear’ higher than it “really is’ going forward. 3% may even been too low, given AIT and so called “low base”.

I have become allergic to any Fed tightening.

‘So, I have mentioned he is so far “on target’—-although it is a very short period since AIT policy began.

Jon Murphy

May 22 2021 at 8:23am

Good stuff, but I put the risk of stagflation higher than you do (I think it’s greater than 50%). I am concerned that even if people do want to spend, there are fewer goods to buy. Various shortages like cars, appliances, etc, indicate that even as people have more money to spend, they’re competing for fewer goods. Inflation goes up, but no real rise in GDP.

If we get production back up, then I’d be less nervous about stagflation. But with high unemployment insurance and a general fear of working during a pandemic, I am not too optimistic.

As a snarky aside, I wouldn’t mind some inflation. I have fixed-rate debt 🙂

Brandon Berg

May 23 2021 at 2:43am

While I’m worried about the fiscal impact of the high unemployment insurance, I’m skeptical that it will have a large effect on real GDP. On the current margin, low-wage workers just aren’t very productive. That’s why they have low wages. So even if 3% of the labor force sits on the sidelines until September, that will suppress real GDP by much less than 3%.

Jon Murphy

May 23 2021 at 6:34am

Two things:

First: the shortage is affecting more than just low-skilled workers.

Second: remember that there are gains from trade. Low-skilled workers contribute to the productivity of us all. The landscaper who cuts the lawn of the doctor allows the doctor to focus on healing. The fast food worker allows the scientist to research. If, say, a scientist has to spend an hour getting lunch rather than 10 minutes (because there is a shortage), the impacts of that will have greater ramifications than simply the marginal productivity of the worker

Jon Murphy

May 23 2021 at 6:40am

One final point: a reduction of 3% or less of GDP would be comparable to the recessions in the 70s

Andrew_FL

May 22 2021 at 10:57am

Actually inflation in the Union was high, too, just not as high as the Confederacy. Civil War era inflation was almost certainly faster than World War I inflation. Based on measuringworth’s CPI index, which goes back to 1774, 1917 comes in fifth place for highest year over year inflation rate (20.5%), behind 1778 (29.8%), 1864 (25.1%), 1863 (24.8%), and 1777 (21.9%). Together with 1813 (20.0%) all have greater than 20% annual inflation rates. Interestingly, George Washington’s first term saw an episode of inflation comparable to the 1970s, an episode which seems to have gone unnoticed and unremarked by economic historians.

The Minneapolis Fed also has a CPI index that extends to 1800. Here 1917 comes in third, in agreement with MeasuringWorth’s index, although their numbers are around 2% lower for all three top ranking years.

I would be remiss not to note that FRED has archived two monthly indices which from the National Bureau of Economic Research’s Macro History Database: “Index of Wholesale Prices, Variable Group Weights” and “Index of the General Price Level for United States”. Now, the former does not extend by itself to World War I but appears mostly compatible with two other wholesale price index series from NBER available from FRED. Using those to estimate year over year rates, 1917 comes in second or third place (the series extend back to 1860 for the “General Price Level” and 1850 for the Wholesale Price Index). “Wholesale Price Index” peaks calendar year 1864 at 44.9% (32.6% for 1917) “General Price Level” at 34.7% (18.1% for 1917). Unrestricted to calendar years, September 1864 yoy clocks in at 82.9% or 57%, (compared to either July or June 1917 43.3% and 22.6%). These are not comparable to the CPI, however.

Only MeasuringWorth’s GDP deflator produces a result where 1917 comes out on top, at 23.3% vs 22.7% for 1864, though notably 1918 comes in fifth behind 1813 here. But George Washington’s first term is again here found to be one of the most inflationary in in history.

Vipal Bhagat

May 22 2021 at 11:10am

Stagflation would not seem to be a future for the developed nations, right now. On the contrary, it might pose a real threat ti the developing nations.

As the economy of USA gaining ground now. It might propel Fed to go for lower interest rates, thereby, pumping the job market and lessening the threat of stagflation, as such.

Cobey Williamson

May 22 2021 at 3:37pm

Inflation and, more importantly, its relative effects in the post-war period cannot be compared with statistics from prior to WWII.

In the epoch before the war, the bulk of the population lived in rural conditions where they could obtain the necessities of life (food, wood fuel) for, effectively, free. These circumstances made high inflation much more tolerable, as anything that needed to be bought could simply be foregone. Today, as it was in the Carter-era, the vast majority of people live in urban settings and are obliged to purchase everything they require for their sustenance. This change in the population paradigm is much less tolerant to high inflation, as we saw during the mid/late-70s and early 80s.

Mark Brophy

May 23 2021 at 6:22pm

In summary, inflation will be in the 5-50% range, but I don’t find that useful because the range is too wide. How likely is it that inflation will increase to 15%? 25%? The inflation indexed bond market isn’t very worried about inflation. Can I earn money by shorting those bonds?

David Henderson

May 24 2021 at 10:00pm

I’m not sure where you get the 50% number. Actually I’m confident that it won’t reach even 10%.

Mark Brady

May 28 2021 at 7:18pm

I’m wearing my instructor’s hat. You write about “the quantity equation or the equation of exchange: MV = Py.” Two thoughts come to mind. It should be written as “Mv ≡ Py”. In other words, it is an identity, and since the velocity of circulation (v) is a real variable it should be written in lower case, if only because you are careful to write “y” to represent real output.

And you mention the German hyperinflation of the early 1920s as one of the three worse hyperinflations of all time. It is almost certainly the best known hyperinflation of all time, but the maximum recorded rate of inflation was well below that of the hyperinflations that shook Yugoslavia and the Republika Srpska in the early 1990s.

https://en.wikipedia.org/wiki/Hyperinflation#Ten_most_severe_hyperinflations_in_world_history

Comments are closed.