Adherents of the Public Choice school of economic thought accept the neoclassical economist’s erroneous views on monopoly and antitrust laws hook, line, and sinker. They take seriously the perfectly competitive model as a criterion against which to measure the operation of the real-world economy. For them, the desiderata is the number of competitors.

But this is highly problematic: how do you determine the contours of an industry? If it only includes car manufacturers, there are but a few of them in any given country, so it is easy to launch the criticism of oligopoly. But why not include trucks? And, maybe, motorcycles. The more expansive is our definition, the less concentration there is. No, motor vehicles do not much compete against modes of transportation such as bicycles or skates, but they most certainly do vis a vis other big-ticket items such as pianos, pricey violins, trips around the world, yachts, etc. If we include them in the automobile “industry” concentration ratios sink like a stone, and with it the plaintiffs’ anti-trust case. Similarly, is the proper “industry” dry breakfast cereal, all breakfast cereal, all breakfast food, all food in groceries, restaurant meals? The more widely we define this “industry” the lower the concentration ratio, and the more like the model of perfect competition we can see emerging. But, the point is, there is no proper, unambiguous, undebatable definition of “industry.” It is very subjective. Plaintiffs want to define it narrowly, defendants, broadly.

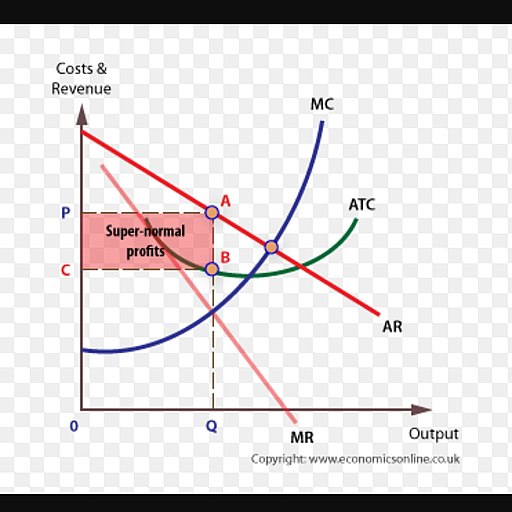

Then, too, that monopoly diagram which undergirds the mainstream economists’ justification for antitrust law is nothing but an exercise in interpersonal comparisons of utility. The dead weight loss is the be all and end all of this model’s claim of market failure. It is used to assert that the consumers more greatly value the amount of product “withheld” from the market, compared to how much would have been produced under perfect competition. If that does not constitute the unwarranted interpersonal comparison of utility, then nothing does.

The public choice position on this matter is indistinguishable from that of neoclassical economics. The point is, if the Public Choicers apply invalid economic theory to politics, this undermines their effort. For example, extrapolating from this invalid tool, they claim that the “more the merrier”: the more political jurisdictions there are in a given geographical or population area, the better. This constitutes a wholesale importation of erroneous economics into politics. If they were to import Austrian economics into their analysis, they would have averred that the greater the free entry into politics the more effective and efficient it would be. This may not be true due to a false analogy between economics and politics, but at least it would not constitute applying mistaken economic theory to the latter discipline.

There is one minor point in this arena that perhaps Public Choice advocates can be congratulated upon: unlike many mainstream economists, they take note of the fact that anti-trust lawsuits are not a free good. Only if the dead weight losses to be banished are greater than these costs, should the plaintiff, private or public, be allowed to go ahead. But this is scarce comfort to economics, since the dead weight loss triangle which underlies the entire initiative is invalid from the outset.

The PCers favor income and wealth redistribution. This, at least, applied to James Buchanan, one of the two founders of this school of thought (the other was Gordon Tullock). Buchanan went so far as to support a 100% tax on inheritance, although most supporters of this school of thought would reject such a radical invasion of private property rights. This not only fails to apply economics to politics, it has the very opposite effect. From the dismal science we learn that if the government takes money from the rich and transfers it to the poor, it reduces the incentives of both to earn income and be productive. The wealthy hire tax accountants to explore “loopholes,” spend time thinking not about how they can innovate and offer a better product at a lower price but how they can avoid taxes. Never far from their thoughts are the grasses that may be greener in other locales. A 100% inheritance tax would lead parents, as if by an “invisible hand,” to make larger gifts to their children, timed before their demise. The ultimate act in this regard would be to time matters so that death barely preceded pennilessness. It is difficult to see how this type of economic imperialism can be an improvement over what the political scientists were all about before this incursion.

Walter E. Block is Harold E. Wirth Eminent Scholar Endowed Chair and Professor of Economics at Loyola University New Orleans and is co-author of An Austro-Libertarian Critique of Public Choice (with Thomas DiLorenzo).

READER COMMENTS

Roger McKinney

Dec 3 2021 at 10:25am

Great analysis! I have read Buchanan’s criticisms of Austrian economics and it’s clear he doesn’t know Austrian economics and fights a straw man. I’m not sure why he won a Nobel for discovering that politicians and bureucrats are human.

Jon Murphy

Dec 3 2021 at 11:00am

Have you read his book Cost and Choice? That’s pretty Austrian.

Jon Murphy

Dec 3 2021 at 11:02am

For some Public Choicers, sure your criticism holds. For others, not so much. I mean, I am a Public Choice economist who makes those very same arguments about monopoly. I learned them from another great Public Choice economist, Don Boudreaux. John Nye, Alex Tabarrok, and many other Public Choice scholars make the same point. Indeed, the viewpoint you discuss is very common at the Public Choice Society meetings. I doubt you’ll find many dissidents.

Jon Murphy

Dec 3 2021 at 4:15pm

This is what I don’t understand. You write:

These are not mutually exclusive positions. They are two sides of the same coin. Reducing barriers of entry (ie, allowing “free entry”) allows for more competitors. If public choicers and neoclassical economists are making the mistake of looking only at the number of competitors, so are you. You’re just looking at it from a different angle.

Comments are closed.