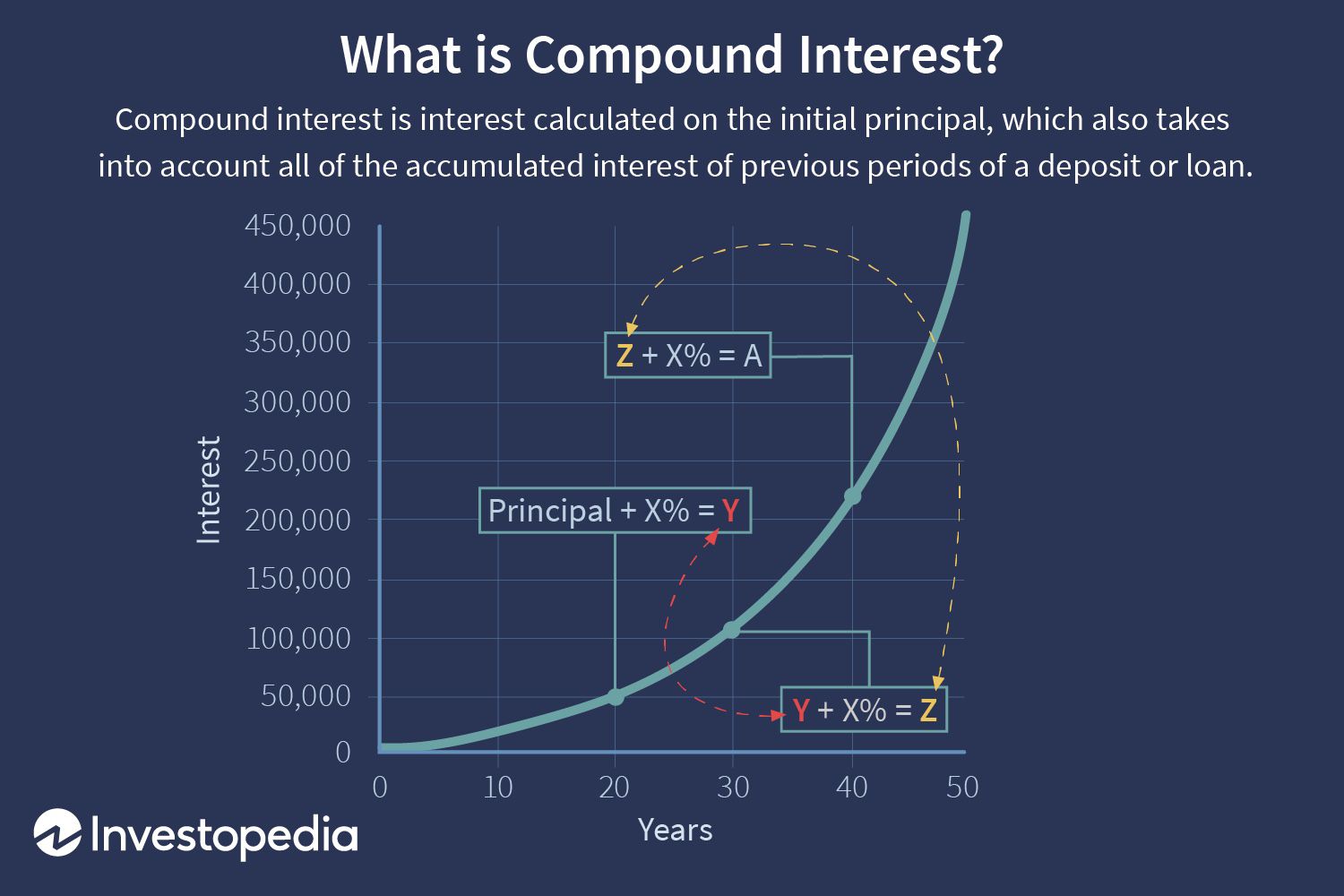

According to an apocryphal story, physicist Albert Einstein, when asked what was the most powerful force in nature, answered “Compound interest.”

Whether it’s the most powerful force, it is powerful.

Here’s a paragraph from Sterling Futures, October 15, 2021:

Including dividends, the S&P 500 Total Return index, in the five years ended September 30, 2021, gained an astonishing +118%, an average annual growth rate of nearly 24%! That’s more than double the stock market’s long-term annual total return of approximately +10% going back 200 years, as described by Wharton Business School’s professor Jeremy Siegel in his seminal book, Stocks for the Long Run!

Can you spot the error? The authors remembered to take account of compounding when discussing Jeremy Siegel’s book, but forgot to take account of it when computing the average annual growth rate of the S&P 500 Total Return index. They appeared to have divided 118% by 5 to get almost 24% annually.

But here’s the right way. Let x = the annual growth rate. Then (100 + x)^5 = 100 + 118 = 218.

Solve for x, which you can do on an iPhone.

x = just over 16%, which is really good, but it’s not 24%.

The power of compounding.

By the way, Jeremy wrote the entry on stock market returns in David R. Henderson, ed., The Concise Encyclopedia of Economics.

READER COMMENTS

Jasper

Oct 17 2021 at 6:49am

To extend your point slightly, if you use e^rt, ie continual compounding, you get an annual growth rate of 15.5%. I’m not sure which one is “better.”

David Henderson

Oct 17 2021 at 10:06am

Good point. Thanks.

Alan Goldhammer

Oct 17 2021 at 8:26am

Years ago I was reading an article that first exposed me to the Rule of 72 which is the simplest way to calculate compounded returns. This can usually be solved in your head if you remember your math tables from elementary school (maybe they don’t teach these any longer). More importantly for me, is the famous inventor and infomercial hawker of items you just had to have, Ron Popeil. In the classic long form ad for his small rotisserie oven, the famous tagline was ‘set it and forget it.’ There are a number of good YouTube clips circulating of this ad. The same thing applies to a well designed investment portfolio. Let compounding be your companion.

David Henderson

Oct 17 2021 at 10:12am

Well said, Alan. When I taught interest rates and explained they are positive (time preference and time productivity), I showed some neat examples such as “Did the Indians who sold Manhattan for $24 in the early 1600s really get that bad a deal for unimproved land?” I also taught the rule of 72.

Then one day I started playing with it and realized that it really should be the rule of 70. I think 72 is used because, as you point out, the math is particularly easy. 2, 3, 4, 6, 8, 9, and 12, which almost covers the range of real interest rates, all go into 72 with the quotient being an integer.

Matthias

Oct 18 2021 at 6:45am

It’s an approximation, but a surprisingly good one.

The rule of 72 (or even rule of 70) works so well, essentially because ln (1+X) ~ X for small X. (Where ln is the natural logarithm.)

Mark Bahner

Oct 20 2021 at 9:31pm

Per this website, the rule of 72 is best for annual compounding, the rule of 70 is best for semi-annual compounding, and the rule of 69 is best for continuous compounding:

Robinhood explains rule of 72

P.S. I’ve never had to examine anything carefully enough to go with the “rule of 69”. 🙂

Vivian Darkbloom

Oct 17 2021 at 6:28pm

Most people forget when compounding returns on investments (for example, the S&P Total Return) that it ignores taxes and inflation. Even if one doesn’t trade, those re-invested dividends are subject to annual income tax (except in IRA’s, 401(k)’s, etc). So, in order to achieve that hypothetical “total return”, one needs, effectively, to invest new money to replace the tax. This diminishes significantly the real compounded return. And, if one considers inflation, the *real* return is reduced even greater. Both can be roughly taken into account by reducing the interest rate in the “rule of 72; however, needless to say, it takes quite a bit longer to double one’s real money when these are taken into account. I doubt Einstein realized that. This is also a huge omission in every main stream article I read about financial and retirment planning.

David Henderson

Oct 17 2021 at 6:46pm

Good points, as always.

Two comments, though:

First, most middle- and upper-middle income people and even most people in the top 20%, such as my wife and me, hold our stocks in IRAs. So the taxes are paid at the end, but the accumulation is tax free.

Second, while your inflation point is a good one, for the last 5 years it has not mattered much because U.S. inflation has been so low. Also, the CPI overstates inflation by about one percentage point–see Michael J. Boskin, “Consumer Price Indexes,” in David R. Henderson, ed., The Concise Encyclopedia of Economics. That means that inflation has been almost negligible.

Vivian Darkbloom

Oct 18 2021 at 12:43am

“Second, while your inflation point is a good one, for the last 5 years it has not mattered much because U.S. inflation has been so low.”

I’m not so sure that this has a significant effect on the time it takes to double your money in real terms. This is because while inflation rates are currently low, so are nominal interest rates. What matters is the real interest rate which doesn’t fluctuate nearly as much. Example: What is the time needed to double your money in real terms given 1) An interest rate of 2 percent and an inflation rate of 1 percent; and 2) an interest rate of 4 percent and an inflation rate of 3 percent? Also, what is the effect of current and deferred taxes in that example?

I agree that given the absence of current taxes in deferred accounts such as IRA’s, the real long-term compounding benefit is higher than in taxable accounts even given the difference in between ordinary tax rates (IRA distributions) and capital gains tax rates. What is the crossover point?

Deferred taxes are *never* discussed in mainstream financial discussions because I assume they are not understood. If you are age 70 and have $2 million in a taxable account and a basis of $1 million, do you really have $2 million to spend? Do you have more or less than a person with $2 million in an IRA? Perhaps the effect of deferred taxes is just too difficult to understand or explain.

Matthias

Oct 18 2021 at 7:04am

If you invest in stocks that don’t pay dividends, but only return money to shareholders via share buybacks, the only taxes you have to worry about are capital gains taxes.

And capital gains taxes can be avoided, for rich enough people, via the buy-borrow-die strategy.

Basically, you never sell your stocks while alive, just borrow against them.

zeke5123

Oct 18 2021 at 11:36am

Of course, this assumes growth. If god forbid you lose value, then the strategy can become very dicey very quickly.

I guess it depends on your portfolio / borrowing levels. If you are worth 10B and decently diversified, then sure borrowing say 15m a year isn’t a big deal.

But if you are worth 10m and are borrowing say 300K a year?

Vivian Darkbloom

Oct 19 2021 at 2:32am

All else equal, that should result in a greater long-term return given the greater compounding effect. However, everything is never equal. The original example was the S&P 500 which does pay dividends. See, e.g., stock symbol SPY. You could pursue this strategy but would suffer lack of diversification. Berkshire Class A might be an acceptable option.

The effect of taxes, fees and trading commissions have a significant effect on compounding and long-term returns. You won’t hear this from stock brokers or pundits who want you to trade and incur not only commissions but taxes. Buying and holding diversified funds such as SPY in taxable accounts significantly reduces that drag but does not eliminate it due to current taxable dividends. If you want to trade or try to time the market, do it in your non-taxable account.

Comments are closed.