A common objection to the simple supply-and-demand model that predicts a shortage when the price is capped below its equilibrium level goes as follows. Why don’t producers just produce more to fill unmet demand? They should be happy to do so. And this would just end the shortage. Correct?

No. This objection is not valid. Producers will only do so if it they make profits, which will not be the case at the capped price. Since quantity demanded is now higher than quantity supplied at the ex ante price, producers would fill the gap only if they could increase production at the same marginal cost, that is, only if they could produce additional units at the same cost. As students learn in ECON 101, marginal cost is increasing in the short-run (and often in the long-run too). This means that producers will be incited to increase production only if the price they get increases.

Technically, the reason is that, with fixed capital (plants, machines, and equipment) in the short-run, any variable factor of production used to increase production (say, labor) will have diminishing marginal productivity. The 10th worker around the machine will have a lower productivity than the first one. An interesting Medium story helps understand; see Will Oremus, “What Everyone’s Getting Wrong About the Toilet Paper Shortage” (April 2).

On the current market for toilet paper, there are two reasons why consumer demand has increased. On the one hand, consumers fear that the shortage will persist or worsen (like in Cuba or Venezuela), so they want to stock toilet paper. Their fears are not without justification, because the government is likely to worsen the problem. On the other hand, people who used to work outside now use more toilet paper at home (40% more by one estimate), as they use none at work (or in restaurants, hotels, or schools).

Another thing to understand is that quantity demanded is higher than quantity supplied because government price controls don’t allow the price to fully adjust upwards. The Medium story is very weak on the role of prices and the impact of price controls, but economic theory can fit this gap and help better understand the economic consequences that we observe.

As usual for all goods and services, the marginal cost of producing toilet paper increases with quantity supplied (produced). The Medium story illustrates that. Take Georgia-Pacific, a leading American producer of toilet paper. Producing more toilet paper for consumers on its current production lines would require more workers, whose marginal productivity would decrease. Working with less equipment, the marginal (supplementary) worker has a lower productivity. Consequently, marginal cost is increasing.

Can’t Georgia-Pacific evade the law of increasing marginal cost by having its commercial production lines produce toilet paper for consumers? No, marginal cost will also increase on these lines. Commercial toilet paper is made of recycled fibre and is less soft and thinner. Even if production lines of commercial toilet paper can be retooled, at a cost, to make a product better adapted to consumer demand, the packaging will also have to be modified. The commercial product is shipped on crates in individually wrapped rolls, rather than in brightly branded packs of 6 or 12. The commercial production lines would need to be retooled at the packaging end too, again at additional cost.

Add to this the cost of distribution proper (which economists include in “production”). The logistics has to change, which probably implies higher costs in the short-run. Walmart distribution centers give a narrow half-an-hour window for supplier deliveries. Moreover, the paper company knows that when people go back to their normal workplaces and the government’s price controls are (hopefully) lifted, the production-line switching will have to be done in reverse.

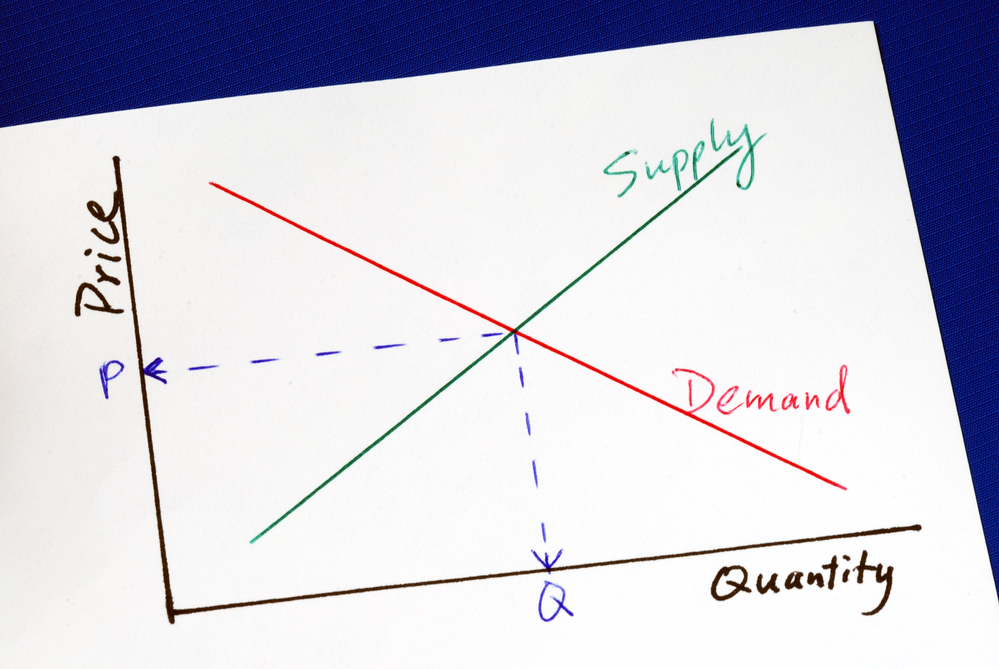

It should thus be obvious that the short-run marginal cost of producing toilet paper increases with production, which means that the supply curve of toilet paper has a positive slope. (In the longer, the industry might have to bid up wages or the prices of other factors of production to divert them from other industries.) The more toilet paper to be supplied, the higher the price must be. (Charities can offer toilet paper below the market price, but they would have to pay a higher price to the producer.)

A Wall Street Journal story of yesterday (“P&G Toilet Paper Factory Keeps Delivering as Coronavirus Strikes its Town,” April 12, 2020) tells us that the Procter & Gamble plant in Albany, Georgia, increased by 20% its production of toilet paper and paper towels. This may be possible, up to a certain point, for a number of reasons. Some equipment might have been idle, as we are told was the case in the P&G plant. The allocation of production across the company’s plants might have changed. Price-control and “anti-gouging” laws often allow some limited price increases, and there may be much arbitrariness in their enforcement. During a crisis, one must not totally discount the desire to make special efforts, even if only for the corporate image, but also possibly for charitable or neighborly motives. But the limits of this flexibility will rapidly be reached when hard financial realities hit.

Toilet paper is not special: all goods, including those in more demand during the current crisis, have increasing marginal costs of production. What explains the current shortage of so many goods is the combination of higher demand, price caps decreed by governments, and increasing marginal.

This simple economic model makes other predictions. Despite price caps, the price of a roll of toilet paper will increase stealthily if the quality decreases: lower quality for the same price. There will be a temptation to produce coarser, commercial-type toilet paper and to sell it at the price of the previous softer variety. But large companies like Georgia-Pacific or Procter and Gamble, which are incited to maintain the value of their brands (which are worth billions or even tens of billions of dollars), will not yield to this temptation except if the shortage situation gets closer to Cuba or Venezuela. But smaller no-brand producers, including entrepreneurs in foreign countries, will work to meet the unsatisfied demand that the shortage implies. Black markets will develop. Many national bottoms prefer coarser toilet paper than none at all.

It may not end there. When the two toilet paper rolls allowed per customer at the grocery store are not available anymore (the price is low but the thing is unfindable), and when jails fill up with smugglers and black marketers (“hoarders” and “profiteers,” as governments have called them across all modern history), some voices will be raised for toilet paper to allocated, and perhaps even manufactured, by the government. Give the production or distribution to the army! (Perhaps after they first tried to have the job done by the FDA, the CDC, or Amtrack?)

Perhaps, one day, when people meet on the street a very old Elizabeth Warren or Donald Trump, they will excitedly beg for an autograph. “He (or she) is the one to whom we owe our federal ration of recycled toilet paper, thank God!”

READER COMMENTS

Dylan

Apr 13 2020 at 8:56am

I don’t disagree with the thrust of your post, but I do have to take exception to this:

That’s a rule for companies operating at peak efficiency and using all of their fixed resources, a situation that I can tell you applies to approximately no one. I’m no economist, but I have spent a fair amount of my professional life evaluating businesses and manufacturing facilities. If they were operating at maximum capacity, that was a big problem, because any growth would have to come from increased capex.

Companies produce as much as they have demand for, which is rarely going to coincide with maximum efficiency. Because of this, the general trend is decreasing marginal costs as production ramps up, until it spikes because you need to build a new factory to increase production any further. If your factory can produce 100 widgets, the 101st is going to be super expensive to produce if you have to build a new factory. You’re not going to want to do that, unless you think you can sell more than just one additional widget.

Of course, it isn’t quite that simple, as there are usually things you can do to increase capacity, at least temporarily, without building a new factory. Some of those will increase marginal costs, and others will decrease them, at least in the short run. Take one example, manufacturing plants can go to 3 shifts and run the plant 24/7. Marginal costs may decrease in the short run when you do this or they may increase, it depends on the interplay of a lot of factors. Do you have to pay labor more to work at night? Can you negotiate better supply agreements by buying in larger quantities? Can the machines operate at better efficiency when running 24/7? Will running all the time introduce a bottle-neck into the supply line that isn’t there when you are running at lower capacity?

None of these things can be determined just from theory, they depend on the specifics of the business. However, the general trend we observed, was decreasing marginal costs as demand increased, subject to spikes when they just couldn’t get any more out of the current infrastructure.

Daniel

Apr 13 2020 at 9:49am

Amen, Dylan.

The basic supply and demand model is great for learning the basics of economics and for illustrating how markets functions given some assumptions, many of which are pretty reasonable. But assuming that firms are currently operating at min MC so that MC curves have a smooth, positive slope is a bit more tenuous. Of course, even if firms are set up to be able to ramp up production a bit in response to higher prices, huge jumps in quantity are infeasible without substantially higher prices because of jumps in the cost curve. Likewise, even if firms are willing to eat temporarily lower profits so as not to expensively restructure production in response to lower prices (say, from a binding price ceiling), huge cuts in price are infeasible without substantially reduced supply. There’s a bit of a tension between implications from the margin and a margin. What does “the” “empirical marginal cost curve” look like?

Jon Murphy

Apr 13 2020 at 10:08am

Dylan-

It looks like you’re confusing the accounting concept of costs and the economic concept of costs.

In economics, “cost” is something that takes place in the future, not the past. It is what you have to give up in order to perform an action: “The cost is not the things – e.g. money – which will flow along certain channels as the result of the decision.” Costs are, to quote G.F. Thirlby “ephemeral.”

So, when you state that a firm “produce[s] as much as they have [quantity] demand for [at the given price],” that implies that they are at minimal marginal cost. Producing more would leave some product unsold (a higher marginal cost because those resources could have gone to other uses) and producing fewer would leave some rent that could have been captured (again, a higher marginal cost).

Pierre Lemieux

Apr 13 2020 at 10:37am

Jon: Instead of “at minimal marginal cost”, you probably want to say “at marginal cost=price”.

Jon Murphy

Apr 13 2020 at 11:57am

Yes, you are absolutely right

Dylan

Apr 13 2020 at 10:48am

Jon,

Perhaps I am confusing the two, although I’d argue that I’m using the terminology in the same way as Pierre is in his post, and the way that makes it the most useful as a concept and not a tautology.

When he says this:

Some equipment (or other resources) being idle is the default state at most companies, yet Pierre acts as if this is a surprise?

Let’s take an example of a company that manufacturers biologic drugs for a very rare disease. Once they setup the infrastructure, the marginal cost to produce an additional unit are very low. They don’t produce more, because there are only so many people who would benefit from the drug, and if you produced more you would have to store it, and there are shelf life issues, and ultimately dispose of the product without being able to sell it. Yes, those are all marginal costs of producing more than you can sell, and so the firm is optimizing at the steady state. But, let’s say something happens, and we find out that there are 10X more people with this rare disease than we thought there were. Is there increasing marginal cost for the company to ramp up production? It certainly doesn’t seem like that to me. They would no longer have the cost of storage and disposal. They could sell the drug for the same price, and increase margins by a large amount. They could even decrease the price by a large amount, and still increase margins, because the marginal cost of producing an extra dose is just so small.

Obviously, toilet paper is a different type of product. It is more of a commodity, until recently demand has probably been pretty stable and predictable, so there is a better chance that producers were operating closer to max efficiency. As I said, I don’t disagree with the basic thrust of the article that we want producers free to be able to raise prices if they need to to respond to changes in demand. I just object to the “all goods, including those in more demand during the current crisis, have increasing marginal costs of production.”

Pierre Lemieux

Apr 13 2020 at 11:05am

Dylan: The distinction between the short-run and the long-run is important. The drug manufacturing industry may have constant long-run marginal cost in producing a known drug (but it may not have past a certain point as they would soon have to bid up factors from other industries). In the short-run, though, they don’t have a constant marginal cost, if only because the marginal cost of distribution and management/coordination would rise.

Dylan

Apr 13 2020 at 12:03pm

The first dose of a new approved drug costs somewhere north of a billion dollars. Are you telling me that the marginal cost of the second dose is higher than that, in the short or long run?

robc

Apr 13 2020 at 12:57pm

Dylan,

if 1 pill is the equilibrium, then yes. If the marginal cost of the 2nd pill < price, they should* be making the 2nd pill.

*I wont be saying “will”, that is too homo economicus for me, I consider the possibility that the drug company could be that freakin’ stupid.

Pierre Lemieux

Apr 16 2020 at 11:24am

The drug manufacturer has built a plant to produce annually 1 million pills. The first pill had a very high marginal cost, that is, the cost of the plant. All the other ones have a very low marginal cost–constant or perhaps decreasing–until the 1,000,000th. Once it produces its 1,000,001st pill, though, marginal cost starts increasing because the marginal productivity of the variable factors it needs starts decreasing (for example, the second guy they add at the end of the line for quality control).

Jon Murphy

Apr 13 2020 at 1:15pm

The cost curve has shifted. The demand curve has shifted and the market price now reflects a higher demand for the good. There is increasing marginal cost for the firm (the equipment being used to produce this new drug is now not being used to produce other drug, the warehousing and transportation is now being used to move this new drug rather than the other drug, etc). Thus, the firm produces more until mc = p.

In order for the firm to increase their production, they need to be compensated for the production. There needs to be a higher price.

Pierre Lemieux

Apr 13 2020 at 10:33am

Dylan: Three points:

1) If you were right, there would be no shortage in grocery stores or online. (On what a “shortage” is, you may want to follow the link to my former post in the post above.)

2) If you were right that firms and plants produce below marginal cost=price, they would leave money on the table. (That may be what Daniel is getting at.)

3) You write that it “depends on the interplay of a lot of factors.” Of course, it does. This is why theory is important: it helps find out which cause has which consequence in what otherwise looks like a big blob.

Dylan

Apr 13 2020 at 11:55am

No, this doesn’t follow at all. You said that ALL goods have increasing marginal costs of production. I say that some goods have increasing marginal costs of production, and that many others can increase production “up to a point” without increasing marginal costs. You provide some evidence to this fact in the post, mentioning that P&G increased capacity by 20% at one factory by employing resources that had been underutilized until that point. I don’t have access to the WSJ to read the details, but it is consistent with my story of lower marginal costs until the firm reaches capacity utilization, and then increasing costs beyond that point.

Help me understand this with real world examples please. My hypothesis, based on observation, is that most companies can increase production without increasing their marginal cost, and in fact lowering marginal cost, if they are able to have better capacity utilization of their plant and equipment. Here’s another example. My wife makes and sells jewelry. She can make one ring in about an hour, or she can make 10 rings in an hour and a half. All inputs other than time are pretty much constant at the level of demand. If she could be guaranteed to sell all 10 rings, she would love to make them all at once. But, because she can’t have that guarantee, she only makes them as she gets the orders for them. I get what Jon is saying, that’s because there is opportunity cost for her to make more rings, she has higher inventory costs, and we can’t use the money she spends on supplies for those rings for other things we need like rent and food. But it doesn’t follow that if she did have the orders, that her marginal cost to produce the 2nd ring would be higher than the first. That might be the case right now (although even there, I’m doubtful, since I don’t think either of us are all that great at optimizing for efficiency), but it certainly isn’t the moment she gets an order for 10 rings. In fact, she’ll give them a discount that reflects her lower cost of production.

Theory is of course very helpful, but as always, it is critical to keep in mind the ways that the real world differs from the model. How well does MC=P explain drug prices, or online movie purchases, or Kindle books?

Jon Murphy

Apr 13 2020 at 1:17pm

No, there is still increasing marginal cost. Average cost is falling, yes, but marginal cost is increasing since these resources needed to be reallocated from other uses (yes, sitting idle is a use). It may not be a steep increase in marginal cost, but it is an increase nonetheless.

Dylan

Apr 13 2020 at 2:40pm

There’s obviously something fundamental I’m missing here. Maybe I’m messing up marginal cost and average cost, although I think I’ve got those pretty straight. I’m going to try one more example, and then try to go and get some real work done today. I’ll do pharmaceuticals again, just because it is a market that I’ve got some familiarity with.

So, I’m a brand new drug company that has been working for a decade to discover a new drug, test it, and bring it to market. My drug has just been approved in the U.S. and I’ve decided to go it alone, and manufacture and sell the drug myself. The demand in the U.S. is estimated at 10,000 doses a year, but it costs the same to build a plant that can make 1,000,000 doses as it does to make 10,000.

I’m making my 10,000 doses for awhile, and then partner with a company that wants to sell my drug in Europe. They will handle all the regulatory, distribution, and selling, all I have to do is get the product to them. They get the product approved, and the demand is for an extra 20,000 doses. Have my marginal costs just gone up? If so, where do those costs show up? Am I going to have to charge more for my drug than I did before? Or, will I be able to sell it to Europe at a much lower price?

Jon Murphy

Apr 13 2020 at 3:00pm

Yes. The resources for those drugs (inputs, time, etc) are not free.

Jon Murphy

Apr 13 2020 at 1:22pm

Hang on, I think I see part of the disagreement here.

P = MC only in a specific situation: a perfectly competitive market. Price can be greater than MC in a monopoly situation (though output would still be where mc = Mr, and thus the general point that you need an increase in price to induce more production still holds).

Warren Platts

Apr 13 2020 at 1:55pm

Hmm.. I guess a vast army of idle workers does serve the use of suppressing wages.

Be that as it may, Dylan is correct because marginal cost curves tend to be U-shaped, just like average cost curves. If you are on the left-hand side of the MC curve, MC decreases with increased production. As production increases further, the MC curve bottoms out and begins to increase even as the AC curve continues to decrease. Once MC > AC, then both MC and AC increases as production increases even further.

Jon Murphy

Apr 13 2020 at 2:09pm

Right, but no profit-maximizing firm operates on the left-hand portion of the MC curve, so it’s irrelevant.

Pierre Lemieux

Apr 13 2020 at 4:00pm

Dylan: I think I and Jon have answered most of your main points. On your last one to the message I am replying to, note that a pharmaceutical producer does have a (temporary) monopoly on a non-expired patent. So it does not have a supply curve or, in other terms, its quantity supplied is not given by its marginal cost (which is, of course, increasing, at least in the short-run). See my post farther down on monopolistic markets.

Let me add one point. Of course, there is uncertainty in production (as in everything). If a firm is building a plant (good for the short-run, by definition of the short-run), its forecasts of future price and cost (and thus how much it will want to produce) are probabilistic. So it will build-in some flexibility in the plant’s size and output. (A plant is not built for exactly 100 widgets; it can be used to produce 99 or 101.) This flexibility will probably already contemplate increasing marginal cost if the most likely production is exceeded. (Remember, as Jon pointed out, that the firm will only produce on the increasing portion of its marginal cost curve.) Such probabilistic calculations don’t change the basic model, although they make them more complicated to manipulate if you are analyzing the toilet paper or the Ferrari market. If your model is as complex as the real world, you have not built a model, but an alternative, side-by-side universe.

TMC

Apr 13 2020 at 10:51am

If I were a producer, I would have put the cases of commercial TP on Amazon at the normal price that they sell it. This would ease residential TP sales for those who want to stockpile and avoid all the issues with price, quality expectations, ect. No retooling to get there or recover from. Enough people would buy it to ease the demand and insulate us from the hoarders. Many people already use the commercial quality stuff at work so that should not be a huge hurdle. A case is 60 rolls, so not a quantity that is too crazy to buy.

Pierre Lemieux

Apr 13 2020 at 8:52pm

TMC: That’s a good point. My guess is that the value of their brand is what prevents them from doing this. And if they did it, they would want a special advertising campaign to make sure consumers understand that this is a cheap version (“for cost-conscious consumers in this time of economic crisis”) of their usual luxury product. These challenges would probably increase their marginal cost in the short-run. But let the shortage worsens, and they will probably revert to solutions like that. I am pretty sure that P&G in Venezuela did not offer 4-ply, 0ne-inch-thick, pure-fiber, virgin-white toilet paper.

Warren Platts

Apr 13 2020 at 1:22pm

I think what Dylan is objecting to is the unqualified, bald statement:

as it seemingly contradicts the commonplace, stylized fact that there are often increasing returns and economies of scale. Is that not the whole point of specialization and division of labor: that by producing more widgets, the price/cost of each individual widget will go down? Indeed, one powerful argument for international free trade is that a single gigafactory in one country can often supply global demand than a hundred different factories scattered all over the world (hence Krugman’s thesis that protections could be justified to ensure the home country gets the gigifactory).

As for toilet paper, it is not the case that the virus is causing a mass wave of dysentery. People are investing in inventory rather than spending on consumption. Thus there is little incentive for firms to increase capacity because once the tp-mania wears off, there will be a significant decline in the demand for toilet paper as people use up their inventory.

Meanwhile, what is the local grocer supposed to do? There will be a shortage in the vernacular sense no matter what. Therefore, some sort of rationing may take place. Sure, we can avoid an economic shortage in the sense that if the grocer jacks the price high enough, the shelves won’t be empty. But that is still rationing; it is just Antoinettish rationing.

Jon Murphy

Apr 13 2020 at 1:26pm

You can have increasing returns and economies of scale with increasing marginal costs. MC can be rising but as long as it remains below AC, you have economies of scale. See, for example, Figure 7.8. Note that marginal costs are increasing from about the 30th unit but average total costs don’t start increasing until about the 75th unit.

Jon Murphy

Apr 13 2020 at 1:28pm

Why are we assuming firms are not profit-maximizers?

Warren Platts

Apr 13 2020 at 2:40pm

We are assuming firms are profit-maximizers. In response to tp-mania, firms will hire a few more workers and thus increase production a little bit. But they will not build greenfield factories because they don’t want to be saddled with a bunch of over-capacity once the tp-mania turns into a tp-crash.

Jon Murphy

Apr 13 2020 at 2:58pm

No, you are not. Firms would not leave money on the table the way you are assuming they are. If the demand were sufficiently high, yes they would go build new factories. But they can shift production around, outsource, etc. To assume that firms would not try to increase quantity supplied (short of government price restrictions) because demand might fall at some point is to effectively assume they are not profit-maximizing.

So, either you’re not assuming firms are profit-maximizers, in which case you need to offer a different explanation for their behavior, or you’re inconsistent in your explanation, in which case you need to correct the inconsistency.

Warren Platts

Apr 13 2020 at 3:24pm

Jon, we are explicitly talking about a demand shock in the toilet paper market in the United States in April 2020 caused by the coronavirus pandemic. I already stipulated that people are not pooping any more than they normally poop. Therefore, real consumption (C) of toilet paper has not changed. All that has changed is that people have decided to invest in toilet paper inventory (I).

So if toilet paper manufacturers ramp up production by hiring idled workers because of the increased demand, who are they supplying? Answer: toilet paper investors, not consumers. In other words, the manufacturers are supplying future competitors. It is not sustainable.

The toilet paper bubble must eventually burst. The manufacturers know this. They know that real consumption of toilet paper has not changed. Therefore, it would be irrational to build expensive, greenfield toilet paper factories in response to a temporary increase in demand that must inevitably be followed by a decrease in demand.

Jon Murphy

Apr 13 2020 at 3:58pm

Be careful here because with these variable labels, I think you’re about to slip into talking about GDP, which is irrelevant here. The standard supply-demand graph is all you need.

Now, whether one is purchasing toilet paper for consumption or to stock is wholly irrelevant.* The demand is increasing regardless.

This doesn’t make sense. I don’t know what you are saying here.

It is true this is likely just a temporary shock, but it still does not explain your claim here, or your original claim “Thus there is little incentive for firms to increase capacity because once the tp-mania wears off.” Indeed, you yourself in this comment contradict yourself by saying there is incentive for firms to increase capacity (“toilet paper manufacturers ramp up production by hiring idled workers because of the increased demand”). Sure, they may not build new factories, but that is only one action they can take. To make the broad, sweeping claim you are doesn’t hold. Plus, there’s still the mere assertion you make that firms are not profit-maximizers.

*It’s also not necessarily correct that peoples re not consuming more toilet paper. Being at home all day, as opposed to the office, means that personal consumption of toilet paper is increasing, by some estimates over 40%.

john hare

Apr 13 2020 at 6:38pm

I think one of the points in contention here is the assumption on profit maximizing. All firms would like to be profit maximizing, but actually accomplishing the exact point on all curves to accomplish that is seriously tricky. So just as the ancient sailors would include a deliberate and known error (sail north of the latitude of the destination and turn south when land is sighted) a firm must choose where and how to err on the side of safety. The side of safety often has excess capacity such that if one production unit goes down, there is enough available slack to meet production goals anyway without increasing costs. At the exact profit maximizing point, any wobble in the system costs money and lowers profits.

I believe this to be the real world stuff Dylan is working on. Absent perfect planning and information that is perfectly executed, a direction of error must be built in. I own extra machines that sit idle much of the time because I can’t afford to have workers without the means to get the job done when we switch trades.

Pierre Lemieux

Apr 13 2020 at 8:17pm

You’re are right. I have written something similar in response to Dylan (see above). All production planning is based on probabilistic considerations. But business owners don’t make them with the goal of losing money.

Jon Murphy

Apr 13 2020 at 1:50pm

Let me try to address Dylan’s point in a different way:

Take a look at Figure 7.8 here.* Marginal Cost (MC) can be downward-sloping at a for certain levels of production, but no profit-maximizing firm would produce on the downward-sloping part of marginal cost since, at the same price level, they could increase production and earn a higher profit (for example, for a price of 4, the firm could produce either 10 units or they could produce 60 units. Their profit is maximized where p=mc at 60 units. I’ll leave it as an exercise to the reader to prove it).

Since a profit-maximizing firm must always be producing where MC is increasing, then in order to produce more, they need to see higher prices.

If a firm is not producing at the increasing portion of the marginal cost curve, we need to ask “why?” We could eliminate the “profit-maximizing” assumption, in which case we’d need something else to motivate firms.

*This is the OpenStax textbook I use in my Principles courses at Frederick Community College and approved by the University of Maryland system.

Warren Platts

Apr 13 2020 at 3:14pm

Actually, in your example, at a price of $4, they would lose money no matter how much or how little they produced because their very minimum average total cost is $6.67 per unit. Therefore, the price must be above $6.67 in order to make any profit.

As for your contention that a firm would never produce in the region where the MC curve is negatively sloped, that sounds like a bit of interesting original research on your part that you should publish because neither your reference nor any others I can find so far say as much. It seems to me it would depend on circumstances: as Dylan was trying to say, a producing firm may not have a choice on how much it can produce because that depends on getting orders. If the firm was big enough to affect the market, increasing production could cause the market clearing price to decline enough to eliminate profit.

Jon Murphy

Apr 13 2020 at 3:20pm

Very good. But doesn’t undermine the point in the least; indeed, proves my point (I leave it as an exercise to the reader to prove it).

Again, why are we assuming firms are not profit-maximizing?

Jon Murphy

Apr 13 2020 at 3:22pm

I mean, if you want proof that firms are profit-maximizing, I suggest you explore the field of Industrial Organization, which has won several Nobel Prizes. Indeed, going through Chapter 3 of the OpenStax textbook I linked too will provide you with proof.

Pierre Lemieux

Apr 13 2020 at 3:40pm

Jon: As you pointed out to me privately, the main issue might be that Dylan assumes a monopoly (or at least much market power), while the model I have been using assumes a competitive market. If that’s true, sorry to have missed that, Dylan. In a monopolistic market, marginal cost is still increasing, of course (it always does when some factors of production are fixed), but a monopoly does not have a supply curve because its quantity supplied depends on marginal revenue and thus on the demand schedule (curve). Price controls need not create shortages if the good is produced by a monopoly: it depends how the demand curve shifts and its (new) elasticity. That a given price control does create as shortage is a necessary (but not sufficient) condition for the hypothesis that the industry is competitive. (In fact, if borders are open, there is a monopoly of a tradeable good only when hell freezes over.)

Jon Murphy

Apr 13 2020 at 4:00pm

Given that we are talking about toilet paper here, I think the perfectly-competitive model is more useful.

Pierre Lemieux

Apr 13 2020 at 4:04pm

Yes, that seems true. And the fact that price controls have created shortages on this market is an indication that it is.

Craig

Apr 13 2020 at 7:21pm

Looking at this article, we see that shipping is somewhat of a constraint.

https://www.wtoc.com/2020/03/25/georgia-pacific-ramps-up-production-amidst-coronavirus-concerns/

So, since the outbreak GP is making more than double what they normally makes.

https://www.theadvocate.com/baton_rouge/news/communities/zachary/article_a970e00c-704c-11ea-ae96-33bbafd3a0e2.html

Also confirmed here at the above link.

“Running low on toilet paper? Georgia-Pacific plant near Zachary maxing out at 120% capacity”

Within the pre-existing capacity, the marginal cost was, itself not a constraint. If it were, they wouldn’t have more than doubled production. But there IS a capacity somewhere. They probably added the “third shift”, but basically whatever those plants can produce, they’re producing.

“”People are requesting twice as much; we are making as much as we can,” said Patty Prats, spokeswoman at Georgia-Pacific’s Port Hudson plant near Zachary.

The toilet paper and paper towel plant is working round-the-clock to meet customer demand” -same link as above

We can see the temporary positions being filled now: https://www.glassdoor.com/job-listing/manufacturing-laborer-temporary-georgia-pacific-JV_IC1155905_KO0,31_KE32,47.htm?jl=3527462796&ctt=1586819664764&srs=EI_JOBS

And there’s Palatka, FL

https://www.glassdoor.com/job-listing/shift-capability-leader-shift-production-supervisor-tissue-manufacturing-georgia-pacific-JV_IC1154274_KO0,72_KE73,88.htm?jl=3490826730&ctt=1586819772397&srs=EI_JOBS

What they’re unlikely to do is expand capacity. Why? Because they see the current demand as a push-forward. So they don’t want to be the dupes with excess capacity.

Jon Murphy

Apr 13 2020 at 8:40pm

But they did expand capacity: “Georgia-Pacific plant near Zachary maxing out at 120% capacity”

Craig

Apr 13 2020 at 10:04pm

Most plants are lucky to be 70-80% and over 80% is typically considered very good. If you’re going over 100% capacity that’s either typically a situation where they are foregoing maintenance or 100% is simply predefined to be something that isn’t actually the absolute physical limit. That’s really neither here nor there, the articles convey the sense that the preexisting facilities are making all they can make. They’re not going to build another factory just because of the current demand because they know its going to snap back to normal and then they’ll two facilities operating at 40% capacity.

Pierre Lemieux

Apr 13 2020 at 8:43pm

Craig: The 213% increase is sales over one week, not a doubling of production, especially not in the whole US market. Part of these sales could have been imported, or taken from stocks (if they still dare to keep some), or produced in production lines with, of course, higher marginal cost (that’s why they had been idled). The 20% production increase that Medium mention is more credible. If you have constantly idle capacity that can produce at the same marginal cost, you would probably look at export markets or to underserved markets in the US. Don’t forget either that, in the absence of a Central Planning Board (which we still don’t have, thank God!), price controls do not include precise and individualized figures but things like “no more than 10% over prices during the past three months” (look at the California penal code, which I quote from memory), or “prices in excess of prevailing market prices” (from Trump’s executive order, literally). So there is a bit of latitude in letting consumer bid up prices along rising marginal cost. I think you can see this in the actual modest increases in toilet paper prices, but obviously, there isn’t enough: the proof is that there are shortages.

Craig

Apr 13 2020 at 9:42pm

“The 213% increase is sales over one week”

And its also a Nielsen stat, industrywide, I did read that a bit too quickly.

But still, the basic point is they’re jacking up their production to the point where they really can’t make much more at their existing facilities.

“The 20% production increase that Medium mention is more credible.”

Well the article actually says reading it closer, “The company is shipping about 120 percent of its normal capacity right now” — kind’ve a nuance, right?

Mark Bahner

Apr 13 2020 at 9:53pm

A person in Florida observed three *barrels* of toilet paper at a convenience store, all single rolls, and selling for $1.75 each, as I recall. My guess is those were single rolls of commercial toilet paper. It seems to me that there should be more of that sort of thing going on.

P.S. I told the person in Florida to pick up one barrel, and carry it to the checkout counter. (There’s always a wise guy! ;-))

P.P.S. But the person in Florida said the people at the checkout counter knew him as an extremely regular customer, so the person in Florida didn’t wan to hurt his “brand.” 🙂

Craig

Apr 13 2020 at 9:57pm

I have two right beside me. I might be Florida Man now, but I’m not shimmying up a palm tree to find a palm frond to wipe my a–. Not yet, anyway. But yes, this is typically what you would find in a rest stop or a McDonalds bathroom…..

Mark Bahner

Apr 15 2020 at 12:16am

Yes, so I don’t see why more of this isn’t going on. For example, schools in most (all?) states are shut down. So why don’t the toilet paper manufacturers just get in contact with Walmart, and suggest shipping the toilet paper that would go to schools to sell at Walmart?

Walmart could sell them with some sort of sign saying, “We apologize for the low quality of this toilet paper, but we figure some toilet paper is better than none. We will work to get our usual quality brands back as soon as possible.”

People in the U.S. seem to be losing their “can do” spirit.

Pierre Lemieux

Apr 14 2020 at 10:30am

Craig: I read “120 percent of its normal capacity right now” as 20% over the full 100% capacity. To be at 120% capacity is not the same as 120% over capacity.

Craig

Apr 14 2020 at 3:21pm

Initially I did read it as more than double their normal capacity. That was incorrect of course. I then read it as 20% more than typical capacity, but actually reading it closer it says shipping 120% of normal capacity. The other article makes no qualification, but if it is simply shipping at 120% of capacity it could be a situation where they are operating at ‘100%’ of capacity’ and they are drawing down inventory, ie imagine a 1000 gallon tank of water where you can only put 50 gallons in per day, but you can widen the spigot at the other end so that you can now take out 60 gallons per day. You will be ‘producing’ at 100% of the 50 gallon capacity, but shipping at 120% of capacity until the water tank is empty.

Phil H

Apr 14 2020 at 2:37am

It took a while, but the problem with what Jon and Pierre are arguing finally emerged deep in Dylan’s post:

Jon: “no profit-maximizing firm operates on the left-hand portion of the MC curve”

This is the problem – it’s mathematically incorrect. If the downward slope of the demand curve is steeper than the downward slope of the supply curve, then they can intersect on the left-hand arm of the supply(/marginal cost) curve. And in fact, this is where the vast majority of companies do operate, because of various possible mechanical/organizational economies of scale.

Jon Murphy

Apr 14 2020 at 8:59am

Well, no. That would imply an upward sloping marginal cost curve at that point (remember the definition of cost above).

Jon Murphy

Apr 14 2020 at 9:02am

Look, a profit-maximizing firm will operate wherever he can maximize profit. By definition, that is never on the downward-sloping portion of the marginal cost curve since, at the same marginal cost, he can produce more units on the upward-sloping portion of the marginal cost curve. If he cannot sell a higher quantity, then the marginal cost is higher because he is foregoing other profit opportunities.

The mistake y’all are making is assuming that the marginal cost curve is independent of the demand curve.

Pierre Lemieux

Apr 14 2020 at 10:41am

Jon:

Of course, the two curves are independent. What you must mean is that a monopoly does not have a supply curve, but it does have a marginal cost curve (which is certainly raising in the short-run).

The problem of our friends is what you pointed out before: they assume that there is only one firm in each market. One must always have in mind the standard graph of a competitive and a monopolistic firm.

Jon Murphy

Apr 14 2020 at 10:44am

Darn it! Yes, that is what I did mean. This is why one shouldn’t blog before coffee

Jon Murphy

Apr 14 2020 at 9:07am

You guys keep wanting to change the model and assume a monopoly condition. However, in the particular case of toilet paper, there is not a monopoly market. The perfectly competitive model works better here.

Pierre Lemieux

Apr 14 2020 at 10:35am

Phil: Either you (like perhaps Dylan) assume a monopolistic market or else you are making a very basic error: confusing one firm on a competitive market and the market itself. A competitive firm faces a horizontal demand curve (given by the market price level).

Phil H

Apr 14 2020 at 12:26pm

Pierre: “or else you are making a very basic error”

Thanks for the condescension, so refreshing.

I mean…

I cannot rule out the possibility that I’ve made a mistake. I’m no expert. But for two people who are so very smugly sure of yourselves, you’re doing a really bad job of explaining this “very basic” point.

*thinks*

I think I have understood what you’re saying: assuming that one firm could produce more for less, it would have done so already and undercut its competitors; therefore in the long run, the scope for such improvements will be ironed out by competition. In practice, it seems to me that very small alterations to the “perfectly efficient” market you assume could easily disturb this equilibrium. For example, if there is an intermediary between vendor and user (big retail), with a preference for diversified suppliers – that could reduce any producer’s ability to cut into other competitors’ market shares.

Thank you for the economic point. It has improved my understanding of simple economic models.

Jon Murphy

Apr 14 2020 at 12:43pm

To Pierre’s point, a lot of this rests on terms that are used differently from colloquial use, so confusion often results. Indeed, in any technical field, basic (which does not equate to “simple”) points can be misunderstood by laymen. Why, just the other day, I was discussing law with a friend who is a constitutional law professor (law is something I study alongside economics, but it is not the subject of my graduate degree the way econ is). I was making a point on a particular interpretation of an action and whether it was constitutional or not. He pointed out that the common understanding of the clause I was citing was X, the actual legal meaning is Y. This was a basic point, but one I got incorrect nonetheless.

Eh, not really. Adding in middlemen doesn’t alter the story much (middlemen exist because of transaction costs. Firms that better work with middlemen grab market share from their competitors). See Chapter 4 here

Jon Murphy

Apr 14 2020 at 12:55pm

To elaborate on my point, adding more and more costs (eg transaction costs, externalities, etc) into the model can complicate the analysis and affect the marginal cost curves, but the overall point, that a profit-maximizing firm operates on the upward-sloping portion of the marginal cost curve and thus to increase production price must rise, remains.

Jon Murphy

Apr 14 2020 at 10:36am

Warren Platts and Phil H-

Here is a better way to explain why a firm will not operate on the downward-sloping portion of the marginal cost curve:

When the marginal cost curve is downward-sloping, so is average costs. The firm can reduce costs by producing more. However, if they cannot produce the required amount to break even (that is, where P=MC=AC), then the firm is losing money will shut down. Since firms are profit-maximizers, no firm will willingly remain in a market where they are making losses; those resources will be re-allocated to other uses.

The firms that can operate on the upward-sloping portion of the marginal cost curve will remain in the market; they are the ones most efficient. The inefficient firms will drop out of the market. Seeing as we are talking about firms currently operating in the market, looking at non-existent firms doesn’t make sense,

In sum: due to whatever restrictions you want to throw, no firm will operate at the downward-sloping portion of the marginal cost curve because they will be operating inefficiently, making losses, and shut down. Thus, while it is mathematically possible for a firm to operate on the downward-sloping portion of the marginal cost curve, it is not economically possible. Just like it is mathematically possible for me to travel to Mars in under 3 hours but it is not scientifically possible.

See Chapter 8 here.

Jon Murphy

Apr 14 2020 at 10:43am

To be clear: in the short-run, a firm could operate so long as P> Average Variable Cost. In the long run, though, a firm will eventually shut down so long as P< Average Total Cost

Pierre Lemieux

Apr 14 2020 at 10:49am

Another way to put your main point, Jon, is that a competitive firm (which can only charge the market price, on which it has no influence) will not produce on the downward-sloping portion of its marginal cost curve because it would be maximizing losses instead of profits. Every single unit it would produce would have a marginal cost higher than the price at which it sells it. (Note, however, that a firm can still make a loss, although not maximizing it, on the upward-sloping part of its marginal cost curve–only if, at that point, average cost is higher.)

Pierre Lemieux

Apr 14 2020 at 10:59am

One other important thing I should point out is the following. Somebody in this long thread mentioned “economies of scale.” One must distinguish the short-run, when, by definition, the size of the plant is fixed and, consequently, marginal cost is always raising (except if the firm wants to maximize its losses); and the long-run, where, by definition, new plants can be built, and long-run marginal cost can conceivably (but not necessarily) be decreasing, which is the area of economies of scale, because indeed the scale of the plant changes. To test one’s understanding, one has to see that in a specific short-run on that long-run path, short-run marginal cost would still be increasing. It’s easy to see all this with graphical analysis (or mathematical analysis for the brave); more difficult with verbal analysis. There is no escaping ECON 101.

Dylan

Apr 14 2020 at 12:54pm

Just going to put in a few comments here as reply to some of the things I’ve seen:

Yes, I’m used to dealing with companies that are closer to the monopoly side of the market than the perfectly competitive side of things. Obviously it is a range, and the companies are not perfect monopolies at all, but all companies I’ve worked with at least aspire to have a “wide moat.

I also don’t work with companies normally that make a profit. I work mostly with startups that can be expected to lose money for a number of years, and most will go out of business before they have revenue, let alone a profit.

Companies typically try to be profit maximizing, or at least welfare maximizing for their managers. But they aren’t perfect at it. Screwing up is way more common than getting it right.

Perhaps it is better to focus just on accounting costs, so that I can understand if we’re on the same page on that at least, because I have trouble understanding both John’s point about demand being a cost, and Pierre’s that supply and demand are independent (since if that is the case, why would companies spend so much on marketing to increase demand?). My contention is that firms very often operate at a place where they are producing widgets for $x a pop, and if they increased production the next set of widgets would be$0.9x, but they don’t produce them yet, because the demand just isn’t there. In fact, they spend huge amounts of their effort to try to increase demand for their product, so that they can get to efficient production scale. I’ve worked with plenty of startups that have sold each item they produce at an absolute loss, trying to goose demand enough to be able to make their products cheaper so they can make a profit. Most of those companies will fail, as most businesses do, but some go on to be wildly successful.

I think it is important to note that I’m not interested in a model of the overall market, but a model of a firm, and the firm should not be assumed to be at some kind of equilibrium.

Jon Murphy

Apr 14 2020 at 12:59pm

That’s because I had muddle brain and made an embarrassing mistake. Ignore that part. That’s all on me.

Right. So you’re incorporating in a monopoly model. The monopoly model doesn’t apply here. We’re talking about perfectly competitive firms. In those markets, firms cannot affect demand at all (by definition).

If a firm cannot operate perpetually on the upward-sloping portion of the marginal cost curve, then they are incurring a loss and will eventually shut down (like many of your start-ups).

Dylan

Apr 14 2020 at 1:37pm

OK, thanks, that helps. The perfectly competitive model is helpful, and I agree a market like toilet paper and other grocery products is much closer to the competitive side of things than the industry I worked in most of my life, which is both a government granted monopoly, but also a market where companies produce products for years without selling the market or making any revenue.

I do think that in real life, for most markets, we’re much closer to a monopolistic competition model, than the perfectly competitive one. I also think that companies not busy being born, are busy dying. So, the equilibrium part of the model is a bit mythical, and while interesting conceptually, doesn’t really tell you where most businesses are on a production curve at any moment in time. I mean, do you know that 2/3rds of all U.S. businesses have less than $25,000 in revenue a year? How many of those do you think are maximizing profit?

Jon Murphy

Apr 14 2020 at 1:43pm

Monopolistically competitive markets are likely closer to the “truth” but the added complexity here doesn’t help a ton. The basic story still stays the same.

Regarding your point that “companies not busy being born, are busy dying,” I say that is absolutely correct (another point in favor of the perfectly competitive market approach is the ease of entry/exit in an industry). But that’s precisely the point: a firm operating on the downward-sloping portion of the marginal cost curve is exiting the market; they cannot survive if they cannot produce on the upward-sloping portion of the marginal cost curve.

Dylan

Apr 14 2020 at 2:34pm

But that’s just it! Most companies don’t survive! The companies that are here today, about 50% won’t exist in 5 years (probably a much higher percentage than that right now, unfortunately). When you’re talking about ALL companies, you need to consider that most are not profitable at a specific point in time. Maybe this is the point that has been missing, because I thought it was too obvious to state? In my career, having done consulting for dozens if not hundreds of companies, the ones that were profitable numbered in the single digits. When we’re describing real life, and not just an economic model, we need to always remember that part.

Those companies that weren’t successful, the problem (at least from their perspective) was usually a lack of demand. They created something new, but couldn’t create enough demand for their new product or service to be financially viable. They built a plant and wanted to operate at max efficiency, but only had enough orders to fill 20% of the capacity. Or in my world, they built manufacturing capacity, but the drug doesn’t work, so demand is zero.

And I still don’t understand this, quite probably because of mixing economic costs and accounting costs, but I’m going to still try one more time.

My wife charges $100 for a ring to a retail buyer. The cost of producing that ring is roughly $25 in material and labor. If she gets an order for 10 of the same ring from a store, she charges $50 a ring. Her marginal cost for materials stays the same, but she is much more efficient at making 10 rings than 1 because a number of the steps can be done just as easily for 10 rings as they can be for one, so the amount of time she spends on any individual ring is a fraction of what it is compared to doing one ring at a time.

She would obviously love to always do 10 rings at a time, but because she doesn’t know in advance when she will get the orders, what size of ring people will need, she doesn’t do that. Without the certainty of orders, she definitely has costs associated with making the extra rings that outweigh the benefit. She has materials that could be used for other things that are tied up in a ring that no one might want. Also, some of the work of polishing and the like needs to be redone when an order actually goes out, because metals tarnish. So I definitely get that she is trying to optimize with her setup the way it is right now (although it isn’t clear that she’s found the right balance yet, she’s experimented with multiple approaches to the problem). However, when the circumstances have changed and she gets an order, those costs that were there before, are no longer there, she’s got no risk of tarnishing because rings will be sent out right away. There’s still an implied opportunity cost, she can’t use that exact metal to do other things, but that cost is minimized now, because the other things are speculative, and the bulk order she’s been paid for.

She would like to operate at this stage all the time (actually, not really, because even though it is more efficient, it isn’t as interesting and she wants to maximize her work satisfaction which is a combination of making money and other interests)…but that doesn’t really matter, because she doesn’t have the option of working at that scale very often. The vast majority of her jewelry gets sold to retail customers.

So, what am I getting wrong when I look at her business?

Is the marginal cost of producing ring 10, higher than for ring 1?

Should I be advising her that she should charge bulk purchasers higher prices for purchasing multiples, instead of lower prices?

Is she not profitable making and selling items individually?

Translate the economic model into actionable business advice, please. 🙂

Jon Murphy

Apr 14 2020 at 2:56pm

If I am reading you right, you’re looking at average costs, not marginal costs.

Right. Because they can’t operate at the upward-sloping part of the marginal cost curve. They still need a higher price in order to produce more, just like other firms. If they cannot get it because demand is not sufficient, they shut down, to Pierre’s point.

I don’t think there’s any disagreement here.

Dylan

Apr 14 2020 at 4:07pm

It costs me $20 to make the first one. It costs me $10 to make the second one. My average cost is $15, but my marginal cost is $10, right?

I can sell 1 at $10,000. The second one I can sell for $5. How many should I make?

Jon Murphy

Apr 14 2020 at 5:50pm

Ok, yeah. This is a monopoly model. Falling marginal revenue faced by the firm is a characteristic of a monopoly model, and thus not part of the point Pierre is making. In a perfectly competitive model, the firm faces constant marginal revenue at P.

Jon Murphy

Apr 14 2020 at 5:56pm

Oh, and let me apologize to Dylan: I was not reading him right. He was not mistaking marginal and average costs.

robc

Apr 15 2020 at 8:33am

That is clearly a monopolistic model. If it was competitive, walmartrings.com would be selling 100k rings at $5.99. In that case, whatever part of the market you went for (match them on price or try to be “premium” and sell for $7 or **shudder** trying to undersell them), you wouldn’t worry about the price being different for #1 and #10. It would be a matter of operating at a level where your marginal cost (and average cost) was below that price.

Pierre Lemieux

Apr 15 2020 at 10:50am

Dylan: Your wife is easy to understand with the competitive model. She is simply investing in her business to produce, and make consumers aware of, her widgets. If she succeeds and consumers discover that this is what they want, she will start producing the widgets in batches of 10 or 100. When a competitive firm is building its plants, it is losing money during that time, and so probably on the first widget it produces when the plant starts running. If the entrepreneur’s guess was correct, the firm will soon get on the upward portion of its marginal cost curve; if not, he will sell the plant, which will be perhaps converted in condos.

Dylan

Apr 15 2020 at 12:13pm

@Pierre: With all due respect, that’s just not how it works. She’s been doing this for about 15 years, mostly profitably, although not always. There’s a rule of thumb in the industry for pricing that is extremely common. Take the COGS of producing one piece and double it. That’s your wholesale price. Double it again, and that’s your retail price. Hopefully you can sell enough for that margin to cover your fixed cost. People use that rule when they are selling jewelry that retails for $10 or $1000 (it gets fudged a bit, but mostly because the artist don’t really have that great of a sense of what their input costs are, so they get roughly estimated).

Besides producing her own lines, my wife has worked for multiple other small jewelry companies over the years, and is friends with lots of people in the industry. I’d say most successful jewelers we know produce pieces individually, even though they could reduce marginal costs by producing in batches. One jeweler gets most of their pieces cast by a third party. There are steep discounts if you cast in batches of 100 or more, driving down unit costs substantially. Yet, they still typically cast pieces individually, or in batches of 5 for designs that are particularly popular. That’s a business that has ~10 employees, and has been around for over 20 years.

@Rob – yes, that example clearly has aspects of a monopolistic market. And it is an extreme and not all that realistic with the numbers I give. But the general idea isn’t unheard of either. Jewelry is on one sense a very competitive market. There are huge numbers of sellers and buyers and little in the way of barriers to entry. Yet, products are highly differentiated, or at least perceived to be highly differentiated. And there are wildly different prices for pieces that are almost identical, certainly are identical from a cost of the inputs perspective.

Pierre Lemieux

Apr 15 2020 at 10:53am

Dylan: You have just confirmed that most firms are in a competitive market. They just make a normal profit (return on capital). If most firms were in monopolistic markets, most firms would make excess profits.

Pierre Lemieux

Apr 15 2020 at 10:43am

Dylan: One of the main arguments of John Kenneth Galbraith was that firms create demand. But if that were the case, no firm would ever fail. In fact, firms try to make consumers discover a demand they had but ignored; or, which is related, try to persuade consumers that their product is different. A pocket calculator is not just a slide rule.

Jon Murphy

Apr 14 2020 at 7:56pm

Let me try to clarify the situation:

Dylan is right that a firm can operate on the downward-sloping part of a marginal cost curve. However, that can only happen when the firm is a monopolist.

For any firm (or individual), the profit-maximizing point is where marginal revenue = marginal cost (I’ll leave it as an exercise for the reader to prove this; it involves calculus and I don’t want to do calculus tonight).

For a monopolist, since they can control the price by restricting output, they face a downward-sloping marginal revenue curve. The firm will produce where Marginal Revenue (MR) = Marginal Cost (MC), and that can be on the downward-sloping portion of the marginal cost curve (see this graph). The monopolist will not produce beyond that point because MR<MC, so the firm’s profit is shrinking.

For a firm in a perfectly competitive market, they face a horizontal marginal revenue curve. This is because neither buyers nor sellers can affect the price. Every single unit sold sells for the same price. Thus, MR = P. For the perfect competitor, they will still produce where MC = MR, but that can occur in two places: the downward-sloping portion of the MC curve or the upward-sloping portion. If the firm is a profit-maximizer, they will necessarily produce on the upward-sloping portion, since that maximizes profit (as opposed to maximizing loss). If they cannot produce at that level for whatever reason, they will have to shut down eventually.

Pierre is discussing a perfectly-competitive market.

Dylan

Apr 14 2020 at 9:18pm

Jon,

Thanks very much for your clarification post that simplifies this long discussion. I agree with everything you wrote, and I apologize if I’ve been coming off as particularly dense these last couple of days. I do remember (barely) my intermediate micro courses, and I’ve probably even had to derive MR=MC at some point in the distant past.

Where my disagreement comes in, is when we rely too heavily on the models when trying to explain what is happening in the real world. The real world where companies don’t operate under perfect competition, where supply and demand curves can be discontinuous, where businesses don’t plan or execute perfectly.

The toilet paper market is closer to perfect competition than a lot of markets, but even here notice that no company is truly a price taker. Charmin Ultra Rolls cost about 3x the price of the least expensive option. I’ve got the choice to buy paper made of bamboo, or paper that is unbleached. Extra soft, and extra big. Back in the good old days when we had choices in these things, I walked an extra 15 minutes to go to a different store to pick up my preferred brand, when my store stopped carrying it.

Economic models are very helpful in trying to understand the world and how things work, and, as Pierre mentioned in a post above, a model shouldn’t try to incorporate everything, because then it stops being useful as a simplifying measure to understand what is going on. I understand all of that, but at the same time, the economist should always remember that it is a model, and that it’s not going to do a very good job of explaining the behavior of any particular firm at any particular time. One of my favorite economics professor quotes from my undergrad days was something along the lines of “It’s a mystery why when you look at any single individual they behave in a way wholly irrational, yet when you take them all together you can model behavior as if they were all rational actors.”

Jon Murphy

Apr 14 2020 at 11:05pm

I didn’t think you were dense at all. This is a very technical subject. And my muddlebrain didn’t help things (again, sorry for that).

Pierre Lemieux

Apr 15 2020 at 11:49am

@Dylan: You may want to scroll up this long thread. I have belatedly answered some of your good questions that I had overlooked.

Dylan

Apr 15 2020 at 1:20pm

Thanks Pierre. Noted your responses and have replied. Really appreciate and am enjoying the discussion and education.

Matthias Goergens

Apr 17 2020 at 2:44am

Luckily, even the strongest price control and subsequent rationing attempts by authorities probably won’t lead to the toilet paper dystopia Pierre paints at the end of the post.

The reason for my optimism: economizing and substitution.

Despite price controls, the real price to customers is going up. That’s because they are partially paying with inconvenience and queuing time. That extra cost is wasted, because it doesn’t flow to the producers as an incentive and reward for producing more toilet paper, but it still makes consumers find ways to cut back.

We have all kinds of other products like napkins and tissue paper people can divert to use as toilet paper. People might find it easier to cut back on whatever they used to use napkins for than cutting back on toilet paper.

On the margin, more people will use water instead of paper. A whole bidet might be hard to find space for, but a bidet shower is comparatively easy to fit. They had already been popular in Asia and the Islamic world.

Comments are closed.