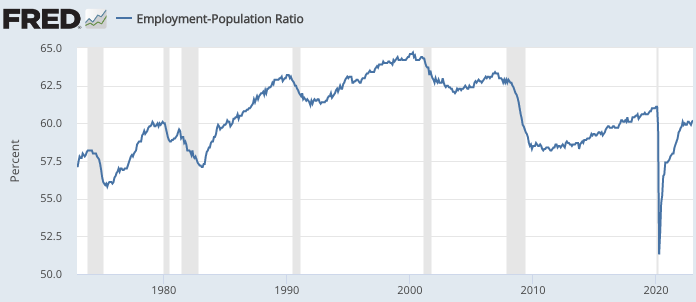

When confronted with evidence that the job market is red hot, naysayers often point to the employment-population ratio (E/P), which remains below pre-Covid levels:

How can this be? After all, the US total population has risen by less than 1% over the past three years. In contrast, payroll employment is up by 2%. Shouldn’t the employment/population ratio now be about 1% above pre-Covid levels?

I found two explanations for this discrepancy. First, the E/P ratio is calculated using the household survey of employment, which is up by only 1% over the past three years. The household survey is widely viewed as being less accurate than the payroll survey, but I don’t have big problem with its use here. Even a 1% rise in total employment slightly exceeds the rate of population growth. So why is the E/P ratio lower than pre-Covid?

It turns out that the E/P ratio is calculated by dividing household survey employment by not the total population, rather by the non-institutionalized population age 16 and over. That seems reasonable, so what’s the problem?

It turns out that the BLS has a very weird estimate of the over-16 non-institutionalized population. They claim it rose by 2.5%, from 259.502 million to 265.962 million over the past three years. In contrast, the BEA says that the total population rose by 0.9%%, from 331.345 million to 334.420 million (which is what basically what the Census Bureau says.) By implication, the relatively small number of children and institutionalized must have plunged by 3.4 million, or nearly 5%. That seems implausible for such a short time. (I couldn’t find precise data, but it looks like the number of American children declined by about 1.6 million over the past three years, and the institutionalized population is quite small.)

I suspect that the BLS estimates of total population over age 16 failed to account for the sharp slowdown in adult population growth due to Covid deaths and a dramatic fall in immigration. And I also suspect that payroll employment is more accurate than the household survey. Put the two together, and it’s reasonable to assume that employment has now exceeded the pre-Covid peak of early 2020, even accounting for population growth. This is especially the case when one considers that the elderly population is the fastest growing part of the total US population, as baby boomers like me retire in large numbers. There is no “hidden unemployment”.

Implications:

1. We are booming; there was no recession in 2022.

2. When strong employment growth is combined with rapid nominal wage gains, there’s no evidence for the claim that the Fed adopted a tight money policy in 2022. It didn’t happen. At best, they adopted a slightly less expansionary policy than in late 2021. But if a driver slows down from 120 to 110 mph, would you describing his driving policy as “slow”? So why describe monetary policy as “tight”?

3. Economists should not be in the business of predicting business cycles. We’ve never been able to do it, and it just makes us look foolish. We look like a bunch of astrologers.

READER COMMENTS

vince

Feb 3 2023 at 2:25pm

“Economists should not be in the business of predicting business cycles. We’ve never been able to do it”

True, but who does that leave to provide such an important factor in policy decisions? Solely market based predictors?

Scott Sumner

Feb 4 2023 at 11:24am

Yes.

Brent Buckner

Feb 5 2023 at 8:56am

OTOH, perhaps having economists’ predictions is part of what informs the market (and so the market-based predictions). It may be analogous to the agents of efficiency in stock market pricing.

John Hall

Feb 3 2023 at 3:16pm

We tend to focus a bit more on the prime age employment to population ratio

https://fred.stlouisfed.org/series/LNS12300060

Scott Sumner

Feb 4 2023 at 11:25am

Yes, but even that underestimates the recovery, as it relies on the household survey. We are probably past the 2019 peak.

Thomas Lee Hutcheson

Feb 3 2023 at 3:42pm

Did anyone ever say there WAS a recession in 2022.

Hopefully Fed _policy_ has not changed; it’s to aim for a flexible average inflation of 2% p.a. of the PCE. What the Fed did in 2022 was change the value of one of its policy instruments.

Agreed except as they want to advise the Fed: “Unless the Fed does X there will be a recession.” “If the Fed does not do Y, inflation will undershoot/overshoot its target.”

JFA

Feb 4 2023 at 7:14am

“Did anyone ever say there WAS a recession in 2022.”

There were 2 consecutive quarters of negative GDP growth in 2022, so almost all Republicans and many news media interviewers started calling it a recession.

Thomas Lee Hutcheson

Feb 4 2023 at 8:07am

Fair enough. I should have said anyone serious. 🙂

Scott Sumner

Feb 4 2023 at 11:26am

Is Robert Barro serious?

https://www.project-syndicate.org/commentary/two-consecutive-quarters-negative-us-growth-predict-recession-since-1948-by-robert-j-barro-2022-07

David S

Feb 4 2023 at 1:43am

I wonder if the impact Covid stimulus cash delayed entry into the job market for a few hundred thousand members of the 20-25 age cohort. Even absent the stimulus effects, the near total lack of service job openings from 2020 through part of 2021 is probably skewing the BLS data a bit. Although those jobs have returned, the tight labor market encourages a young person to look longer for better paying positions.

On the other side of the prime age cohort, people in the 55 to 62 age range probably accelerated their retirement. Or, as Scott notes, died—or continue to suffer from long Covid.

Scott Sumner

Feb 4 2023 at 11:29am

One way to make my point is that the worker shortage is too much demand, not a lack of supply. Payroll employment is 3 million above the previous peak. There’s no lack of workers, just too much demand.

Lizard Man

Feb 4 2023 at 2:09pm

Could we have had the same level of employment with less inflation if policy had been better?

Scott Sumner

Feb 4 2023 at 10:23pm

Perhaps not precisely the same, but basically yes. We could have had significantly lower inflation and employment pretty close to where it is today.

Andrew Smith

Feb 5 2023 at 11:16am

The US like most places the working age cohort passed the ‘demographic sweet spot’ pre Covid as the ‘baby boomer bomb’ transitions to retirement i.e. more seniors due to better health and more longevity.

OECD trends show the dynamics amongst different age cohorts very well e.g. working age cohort, like the younger cohorts following, are of the below replacement fertility.

OECD (2023), Working age population (indicator). doi: 10.1787/d339918b-en (Accessed on 05 February 2023)

OECD (2023), Young population (indicator). doi: 10.1787/3d774f19-en (Accessed on 05 February 2023)

nobody.really

Feb 6 2023 at 11:18am

“The only function of economic forecasting is to make astrology look respectable.” Ezra Solomon, Burmese-born American economist (1920–2002), The Bulletin (1984), Reader’s Digest 1985; often misattributed to J. K. Galbraith following a humorous piece in U.S. News & World Report (March 7, 1988).

David Su

Feb 8 2023 at 2:35am

I look at it this way: Planning is essential. A Plan is useless.

(Learned that from the Marine Corps)

Basically, attempting to predict the business cycle is useful, as you learn from it. Saying that you have predicted the business cycle just makes you wrong…

Comments are closed.