I often debate the question of whether severe slumps are caused by financial crisis or tight money. In my view it’s usually tight money, with financial stress being a symptom of falling NGDP. So how would we test my hypothesis?

While cleaning out my office at Bentley, I came across an old NYT article from June 11, 1933:

Wall Street notes a remarkable contrast between the attitude toward the war debt question last December and that of the present time. Last year, financial circles began to become apprehensive about the war debt question long before December 15. By late November the pound sterling had fallen to a record low of $3.14 1/2 and the financial markets were severely depressed. At the present time, although the war debts payments are due by next Thursday, there has been almost no discussion of the subject in financial circles, and the possibilities of wholesale default have left the markets unperturbed.

Why did the markets suddenly stop caring about the war debts issue in June 1933? For the same reason they suddenly started caring about the war debts issue in mid-1931. War debts disturbed the financial markets when they led to devaluation fears, which triggered massive gold hoarding. By June 1933, the US was off the gold standard, and hence gold hoarding no longer exerted a deflationary impact on the US. However, gold hoarding continued to be a problem for countries still on the gold standard, such as France.

In my book entitled “The Midas Paradox”, I did a very extensive empirical study of this question. The price of German war debt bonds suddenly become highly correlated with US stock indices in mid-1931 (when Germany got into financial trouble), and this continued through 1932. Fears of German default were triggering a loss of confidence in the international gold standard. That loss of confidence was justified, as Germany adopted exchange controls in July 1931 and the UK devalued in September 1931. At that point people started worrying about a US devaluation, and gold hoarding rose sharply.

Because the supply of newly mined gold doesn’t change very much from year to year, big changes in the value of gold are primarily caused by shifts in gold demand. But once the US began devaluing the dollar in April 1933, increases in gold demand no longer had a significant deflationary impact on the US. Gold kept getting more valuable, but now the dollar was losing value. (Recall that price deflation means that money is getting more valuable.)

Back in 1932, the vast majority of serious people rejected my “tight money” explanation of the Depression. It was “obviously” caused by financial turmoil, both domestic and international. Falling NGDP was seen as a symptom. Only a few lonely exceptions like Irving Fisher and George Warren took a “market monetarist” perspective, urging a shift toward expansionary monetary policy. Because we were near the zero bound, they recommended a depreciation of the dollar against gold. In 1933, FDR adopted their suggestion, and it worked just as Warren and Fisher predicted—prices and output immediately began rising sharply. The policy would have been even more effective if not offset by the NIRA, which sharply reduced aggregate supply.

And there is lots more evidence for the tight money—>falling NGDP—> financial distress chain of causation. After the dollar started depreciating against gold in April 1933, domestic bank failures ceased almost immediately.

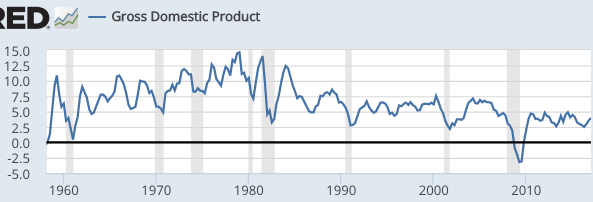

Some people claim that tight money did not cause the Great Recession, because there was no alternative monetary policy at the zero bound of interest rates. But something similar occurred in the 1980s, when we were not at the zero bound. Between 1934 and 1980, there was a period of calm in the banking system. Some people wrongly attribute that to regulation, but in fact it was caused by higher rates of inflation and NGDP growth during 1934-80, which made it easier for debts to be repaid. As soon as the Fed adopted a tight money policy in 1981, and NGDP growth began slowing sharply, we experienced a bout of bank failures (mostly S&Ls). The causation in this case clearly went from tight money to sharply slower NGDP growth to banking distress, as we were not even close to the zero lower bound on interest rates.

To summarize, the question of whether tight money or financial distress causes deep slumps might seem almost unsolvable, if you simply focus on the Great Recession. But those with a deep knowledge of economic history know that causation clearly runs from tight money to falling NGDP to financial distress. Unfortunately, economic history is no longer widely taught in our graduate programs, so we now have an entire generation of economists who are ignorant of this subject, and who keep developing business cycle models that are easily refuted by the historical record.

READER COMMENTS

rtd

May 19 2017 at 12:57pm

Given that you prefer NGDP growth as the indicator of the stance of monetary policy, the above seems tautological.

Scott Sumner

May 19 2017 at 2:41pm

rtd, I am also saying that NGDP is controllable by the monetary authorities.

Colin W

May 19 2017 at 4:32pm

That story could also help explain the finding in the work by Alan Taylor and co-authors that “credit growth” does a better job than bank capital at predicting the occurrence of financial crises.

Lorenzo from Oz

May 19 2017 at 7:23pm

Pointing out that history, it matters, always warms the cockles of my heart.

(That my business is putting on medieval and ancient days for secondary schools perhaps helps — let me explain Chinese history in 50 minutes in a engaging way to 12 year olds* — …)

*It’s about farmers and nomads. Or putting this map in context.

Scott Sumner

May 20 2017 at 8:29am

Lorenzo, Nice map.

Thaomas

May 20 2017 at 10:36am

This contrast seems a bit superficial. Is it not possible that a financial shock causes a shift in AD (investors become more nervous, consumers increase ex ante savings) and then monetary policy by failing to properly offset the deflationary shock, allows a full blown recession to develop? I stipulate that if, the central bank had, before the shock, established credibility that it was targeting the PL or NFDP, the recession could hardly get going, but that is not the world we inhabit. Still I think that it is analytically convenient to separate the shock from the monetary policy mistake

Scott Sumner

May 21 2017 at 11:03am

Thaomas, In my view, the most interesting counterfactual is what happens if there is a financial crisis but no fall in NGDP growth. I believe most people think RGDP would still fall sharply—I have my doubts.

Jacob Egner

May 22 2017 at 12:43am

Scott Sumner:

You say “the Fed adopted a tight money policy in 1981, and NGDP growth began slowing sharply, we experienced a bout of bank failures”.

I’ve heard that the health of the US economy of the 1980s was way better than what came before. Did money policy soon loosen or did some additional things happen to help the US in the 1980s?

Thanks,

Jacob

Thomas Hutcheson

May 22 2017 at 8:16am

Scott poses:

First, I’d say we really ought to have a Fed policy that tests this condition. 🙂 [The same might be couched as no fall off the target price level trend.] (And I’d be interested to know what actions or inactions the 2008 Fed should have done to achieve a non-fall in NGDP)

Unfortunately, I’d also say that “most [economist] people” have no thoughts about how much and whether RGDP would fall and (or because?) “most” models are not set up in a way to examine this possibility. If they/we did consider it, I’d guess that it would devolve into a question about the nature of the financial crisis, presumably as the counterpart of some more fundamental “real” imbalance — over-production of some kids of goods relative to others — and the temporal difficulty (a la Leijonhufvud) of “finding” a new wage/price vector to achieve a new inter-temporal equilibrium.

In practice I very much share your doubts that the real effects would be very large. And in that sense, your contrast that I called “superficial” is valid.

Scott Sumner

May 23 2017 at 10:16pm

Jacob, We had good supply-side policies during the 1980s (and 1990s). But we had a banking crisis despite the good economy, due to a combination of moral hazard and slower NGDP growth.

Thomas, I suppose the 1980s S&L crisis is the closest example I can think of to a financial crisis without an big drop in NGDP growth.

Jacob Egner

May 26 2017 at 12:15pm

Scott Sumner:

Thanks for the answer. Also, thanks for significantly changing my monetary policy views with your previous writings.

–Jacob

Comments are closed.