To write about statistics and Cuba is, inevitably, to speak of oxymoronic terms. Whenever someone tries to approach the Cuban case from the lens of years prior to 1959, or even after, the stats are either obscure, non-transparent, or nonexistent.

That is not to say that the work in this field does not exist. On the contrary, various third parties have tried to devise ways to analyze the Cuban case. Some of these individuals and organizations have been elToque, Steve Hanke, and Pedro Monreal. Yet, it is indispensable to make the clear and concise statement that even with these contributions, we still are behind the curve regarding information on the Cuban economy.

On the side of the Cuban regime, the National Office of Statistics, commonly known in Spanish as “Oficina Nacional de Estadistica e Informacion” (ONEI), has done a choppy job of providing precise and transparent details that we can rely on, as has been pointed out by Diario de Cuba. Every statistic or graph you may see about the state of the finances of the Cuban state or its economy must be taken with a pinch of salt.

The other day, I came across a graph Hanke posted on his Twitter timeline, stating that Cuba’s inflation was 81%. Such a number significantly impacted me. Since the pandemic is already over, reforms are on their way to shape a “private market,” and even remittances would start reopening. At this point, there was no excuse for the Cuban government not to control the inflationary pressures. The Economy Minister of Cuba, Dr. Alejandro Gil, has said numerous times that the leading cause of inflation in Cuba was a “national deficit in the supply of goods.” Although the wording of the reason is confusing, Gil is saying there are not enough products in the peso denomination to back up the notes the government has been emitting. In other words, a generalized scarcity provokes prices to soar. Nonetheless, this does not make any sense. In any “normal country,” the central bank or even the government would look to control inflation by decreasing output using monetary policy.

Monetary Theory in Action!

Following this logic, I was excited to test Milton Friedman’s famous quote where he said: “Inflation is always and everywhere a monetary phenomenon.” To clearly demonstrate this, I prepared a graph in the old, classy way Milton Friedman would do it. Although I took the M2 data from the ONEI, since there is no other alternative source to refer to, I used the GDP deflator from the World Bank for my inflation rate. Even though it seems awkward to today’s standard to use GDP deflator as a measure of inflation, it was the only measure I found that had provided data since the 1990s. The results are expressed in the graph below.

Source: Oficina Nacional de Estadistica e Informacion (2021) & World Bank (2021)

Even the most brute eye test would see that as the quantity of money increases, prices must also increase. As if it were necessary, I also did a correlation test that came up to approximately 0.91.

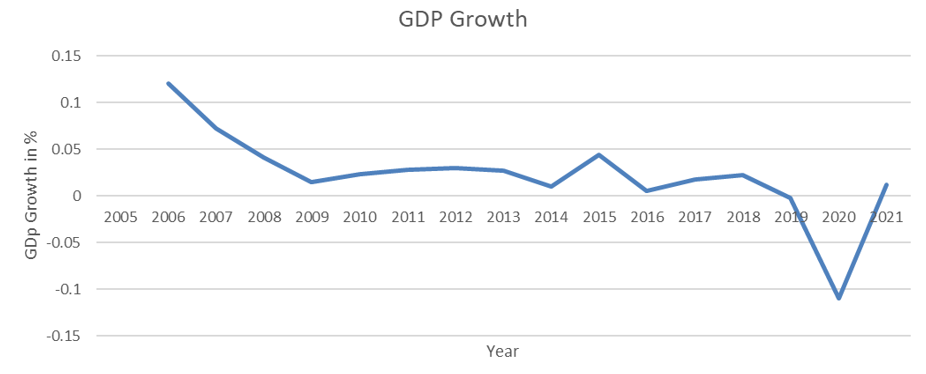

The question that now arises is, why would the Cuban government debase its currency so heavily? The answer to this, as some may guess, is complicated. If we outline some of the reasons, we would definitely conclude that the economy has not recovered yet from Covid. Even after two years, the Cuban economy is taking time to get back on track. The evidence of this is that the GDP growth is still lower than before the pandemic. That might cause the public revenue to decline, forcing the government to spend more.

Source: Oficina Nacional de Estadistica e Informacion (2021)

Also, with inflationary pressures underway, the government increased the salaries of the public workers, which instead of helping, added more gasoline to the already burning fire. Rafaela Cruz, a Cuban economist, noted that these increases in wages would cause increases in the base money to meet these. Again, given a wrong diagnosis, it is not weird to expect an incorrect solution.

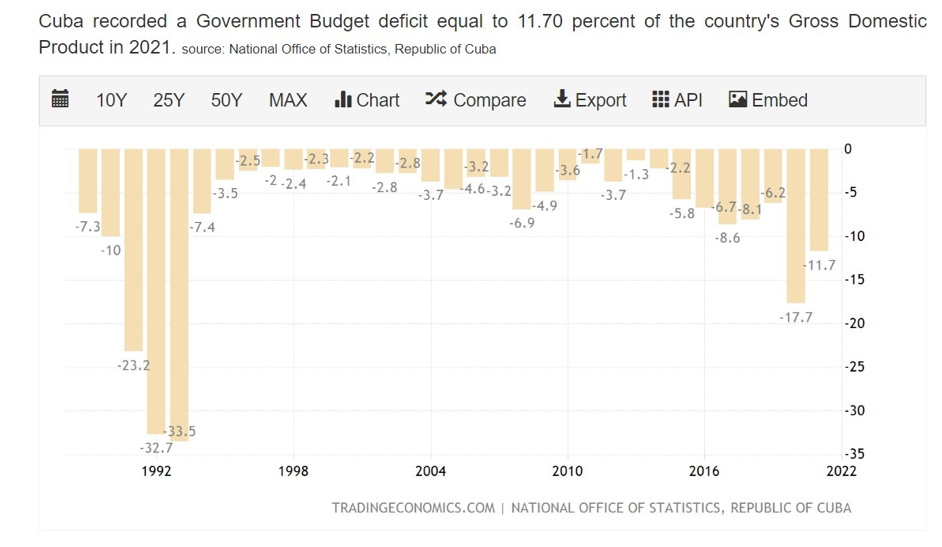

Finally, a notable mention is that Cuba’s budget deficit is only comparable to what it had in the 1990s when the special period was taking place. In fact, last week I tweeted the graph below, showing the budget deficits as a percentage of GDP. Although these deficits may not explain the increases in the monetary bases altogether, it partially puts color into why the Cuban government has been printing money lately. As a last remark, we must remember that Cuba is involved in a court case that would determine whether Cuba would default on its debt.

Source: Trading Economics (2021)

Conclusion

The monetarists‘ premises still apply to today’s economies, showing how increases in base money would inevitably lead to price increases. The Cuban case is one of the many still to be studied and described to the public. Old monetary doctrines are no longer dead; they were never killed, just forgotten.

Carlos Martinez is a Cuban American undergraduate student attending Rockford University. He is pursuing a BS in financial economics. Currently, he holds an Associate of Arts degree in economics and data analysis.

READER COMMENTS

Henry

Apr 8 2023 at 1:20pm

Is there a significant unofficial economy in Cuba? I was in Argentina about six weeks ago. Argentina is also having substantial inflation. However, I got the sense from my friends who live there that the dollar denominated informal economy had real impacts. Dólares azules aren’t really legal, but there is no enforcement of those rules. Every restaurant and retail business responded to “tengo dólares” favorably. I couldn’t use credit cards, but cash greenbacks were appreciated.

Morgan

Apr 9 2023 at 10:09am

I was there in January. Yes, Cubans prefer US dollars because they are more stable and hold more value. There is also a much more favorable dollar to peso exchange “on the street” than the official exchange rate. Another strange phenomenon is that there are government stores that don’t sell anything in pesos, only with debit cards with currency based in Euros, dollars, etc., but the only people able to obtain that are ones with relatives outside the country who put money in these accounts. It creates a strange reverse black market because these people then sell these items for a profit in pesos. It makes for a double advantage for them and a double disadvantage for those with no one putting money in their accounts outside the country. The average Cuban is really struggling. I don’t know if it’s as bad as the “special period”, but it’s bad.

Henry

Apr 11 2023 at 3:08pm

I’m not very knowledgeable about economics, but it seems to me that a significant gray economy in an alternative currency would create inflationary pressures as vendors prefer the alternative over the native currency. If people prefer dollars over pesos, then peso denominated prices will go up. If there is already an eponym for this, please inform me.

Richard W Fulmer

Apr 9 2023 at 10:55am

Wouldn’t the influx of money from overseas increase competition for scarce goods, thereby further fueling inflation?

I think that it does make sense. COVID reduced Cuban production, and, at the same time, it also led to increased government spending. While the worst of the pandemic appears to be over, production didn’t ramp back up immediately and demands for increased government spending didn’t cease immediately. The Cuban government is still using resources and it still has to pay for those resources. With a reduced tax base, its only options are to either borrow or print money or to drastically cut spending.

Knut P. Heen

Apr 11 2023 at 6:08am

You don’t need evidence to prove that inflation is a monetary phenomena. It is a definition. The price of a good may change due to changes in supply/demand or it may change for monetary reasons inflation/deflation. The latter tends to affect all goods while the former is local to the good (and related goods). Changes in the supply/demand of energy may affect all prices and is therefore more difficult to separate from inflation/deflation. Inflation should be easily seen in the exchange rates if the inflation is very different from the Dollar or the Euro. Changes in the Peso-Dollar exchange rate in the black market should give a clear indication of inflation. My understanding is that Cuba also have had problems with the supply of energy. They used to send doctors to Venezuela in exchange for oil. I don’t know how that deal has been working out lately.

Comments are closed.