Finding mistakes in the media is like shooting ducks in a barrel. But I hope today’s post will do more than take a few potshots, I am going to try to illustrate some fundamental problems with macroeconomics.

The Economist has an interesting article discussing the inflation that hit Europe in the period around 1500-165o. They point out that currency debasement does not provide an adequate explanation:

Spain stopped debasing entirely from 1497 to 1686. Some historians, therefore, follow Bodin and say that demand-side explanations by themselves are insufficient. They also look at what was happening across the Atlantic, the source of a huge supply shock to Europe’s economy.

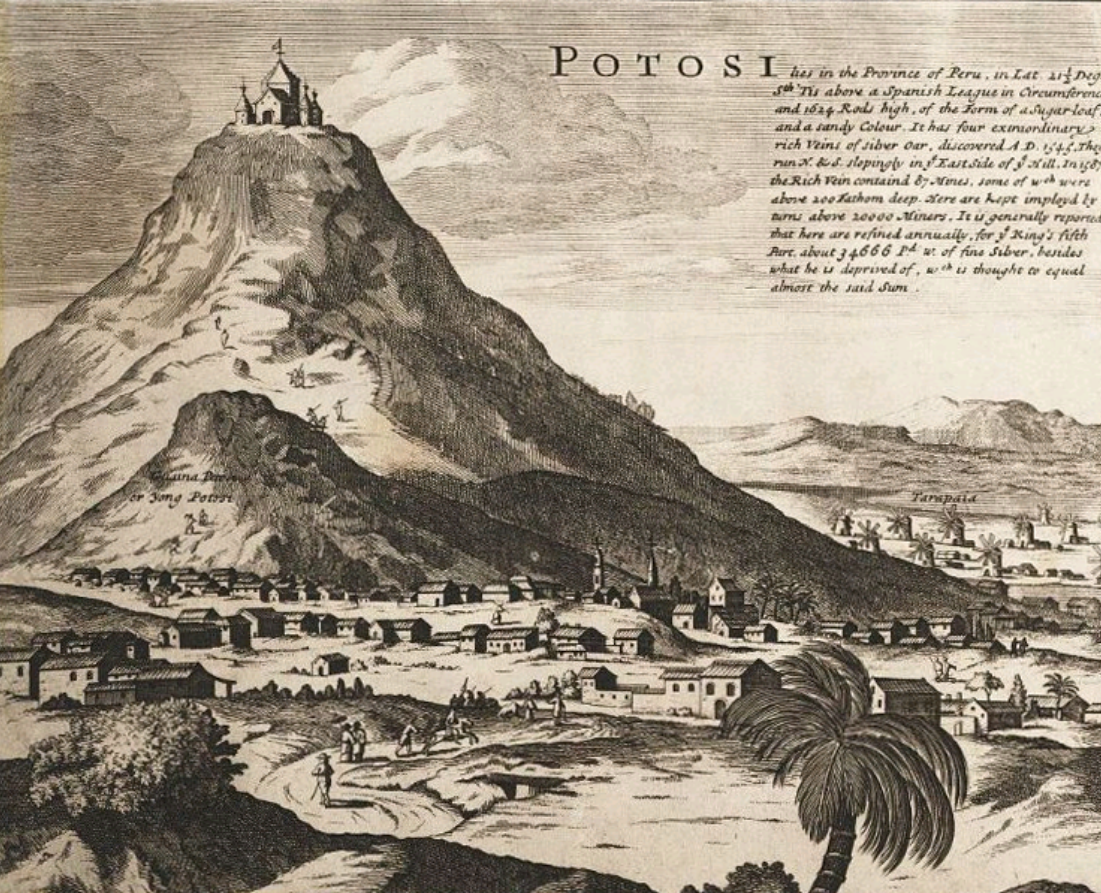

In about 1545 people discovered vast silver deposits in Bolivia. Potosí, the centre of this lucrative new industry, became perhaps the fifth-largest city in the Christian world by population (after London, Naples, Paris and Venice). In the first quarter of the 1500s just ten tonnes of silver had arrived on Europe’s shores. By the third quarter of the century Europe imported 173 tonnes. Spain, where much of the metal arrived, initially experienced especially high inflation—but it then spread across the rest of Europe, as far as Russia.

This left me scratching my head. The first paragraph suggests that demand side explanations are not adequate, and that we need to consider supply shocks. But the second paragraph discusses a demand shock, the huge increase in silver production out of Potosi. In those days silver was money, so the second paragraph is essentially describing a big increase in the money supply. Why does The Economist describe it as a supply shock? The supply of money impacts aggregate demand, not aggregate supply.

Eventually, the great inflation came to an end. Population growth slowed, reducing demand for goods and services.

I had to frequently correct my students on this point. Slower population growth reduces aggregate supply, not aggregate demand. This would actually increase inflation. The Black Death was inflationary because it killed people but didn’t kill silver coins. It was a negative supply shock. Population growth does not boost aggregate demand, at least in the long run (which is what is being considered here.) Rapid population growth in the US during the late 1800s caused deflation, as output rose faster than the money supply (which was pegged to gold at the time.)

I suspect that most people (and even some economists) have an idea in the back of their minds that AS/AD is sort of like supply and demand. Not so, the two models are completely unrelated. More supply of money means more demand for goods. For any given money supply, more people means more aggregate supply, with little or no change in aggregate demand.

Wouldn’t there be more people out shopping if the population increased? Yes, but each person would possess fewer silver coins. Thus the total amount of nominal spending (aggregate demand) does not increase when the population rises. If you prefer, an increase in Y reduces P, holding M*V constant:

M*V = P*Y

Any intuition you have for ordinary S&D simply does not carry over to aggregate supply and demand.

PS. The Economist article is actually very good, despite my quibbles, and well worth reading.

READER COMMENTS

Physecon

Feb 2 2023 at 2:48pm

I’m having trouble fully reconciling some of your statements. If population increases then Velocity, all else being equal, should be expected to increase. Maybe each person possesses fewer coins at any given time, but the coins may circulate faster. I reckon this would all be highly dependent on demographics and pace of population increase.

Scott Sumner

Feb 2 2023 at 6:50pm

I see no reason why an increased population would boost velocity. When I decide how fast to spend money, I pay no attention to the size of the US population.

Physecon

Feb 3 2023 at 1:36am

When those additional people are buying the same things you want to buy and prices rise then you will increase your velocity.

Michael Rulle

Feb 3 2023 at 7:44am

I uses to think one of the differences between Friedman and Scott on money supply was Scott factored in velocity (I thought he said that once—maybe he never did). I do know that velocity and supply appear negatively correlated—or have in recent decades. Scott does not discuss velocity anymore—-at least on his blogs. Of course, I am probably wrong.

One thing I know is I am one of those guys who don’t understand Macro. I do believe Governments are too involved with our economy. I also believe they effectively and de facto believe in broken window thinking (break a window and increase economic activity) and offshoots from that way of thinking. War is the ultimate broken window theory——except when ignoring it can destroy society.

Scott Sumner

Feb 3 2023 at 11:54am

But the increased population will not boost inflation. So again, why would velocity rise? You cannot simply assume your conclusion.

Loquitur Veritatem

Feb 2 2023 at 4:05pm

“Slower population growth reduces aggregate supply…”? Growth is positive — whether it’s slower or faster. How does growth reduce aggregate supply?

Kenneth Duda

Feb 2 2023 at 6:15pm

Loquitur, I think what Scott meant is that if the population grows more slowly than expected, then aggregate supply will increase less than expected. Put another way, aggregate supply is reduced compared with what it would have been with higher population growth. Put another way, if you cause slower population growth, then you will reduce the growth in aggregate supply as well.

$0.02

-Ken

Scott Sumner

Feb 2 2023 at 6:49pm

Yes, that’s what I meant. Note that I said it should increase inflation, which is the rate of change in prices.

Market Fiscalist

Feb 2 2023 at 8:27pm

This post has made me question the usefulness of the supply-side v demand-side way of explaining inflation that has been used widely over the last 18 months!

Inflation can be caused by either an increase in the supply of money or a decrease in the demand to hold money. It can also be caused by a fall in the supply of goods and services or (I suppose) an increase in the demand to hold on to these goods and services by their producers.

It seems that it may be better to classify inflation as caused by either money-related factors or non-money related factors. Of course the money-related causes are the more common and the ones CBs need to focus on.

Rafael

Feb 3 2023 at 10:58am

Agree 100%.

People always seem to forget (or never knew) the second part of Friedman’s famous quote (which is the most important in my opinion):

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

BK

Feb 3 2023 at 3:06am

Never reason from a population change. More people could lead to more money supply (= greater aggregate demand) if the culture commonly has interpersonal credit arrangements. Credit is a form of money after all.

Scott Sumner

Feb 3 2023 at 11:55am

Empirical data suggests that population growth boosts money demand by more than it boosts money supply, hence it’s deflationary.

Michael Rulle

Feb 3 2023 at 7:59am

Re credit:

When banks make loans they create money——not base money——I don’t think—-but M2.

Richard W Fulmer

Feb 3 2023 at 9:42am

The way I think of it is that banks don’t create inflation, they amplify it via the fractional reserve system.

Spencer

Feb 3 2023 at 10:02am

AD ( ≠ ) PY

AD = M*Vt

M*Vt = P*T

AD is still too strong. There’s such a thing as momentum.

“Quantity leads and velocity follows” Cit. Dying of Money -By Jens O. Parsson

“Money has a ‘second dimension’’, namely, velocity . . .. ” Arthur F. Burns in Congressional Testimony.

That’s why one examined the G.6 Debit and Deposit Turnover release (discontinued by mistake). You could expect velocity to accelerate (and to never decline) after a surge in the money stock.

Bernanke: ”

Attempts to find stable relationships between M1 growth and growth in other nominal quantities were unsuccessful, and formal growth rate targets for M1 were discontinued in 1987… Unfortunately, over the years the stability of the economic relationships based on the M2 monetary aggregate has also come into question.

As I have already suggested, the rapid pace of financial innovation in the United States has been an important reason for the instability of the relationships between monetary aggregates and other macroeconomic variables”

The G.6 release fell to President Bill Clinton’s “Paperwork Reduction Act of 1995”: From the Federal Register: “The usefulness of the FR 2573 data in understanding the behavior of the monetary aggregates has diminished in recent years as the distinction between transaction accounts and savings accounts has become increasingly blurred (And that’s also what Chairman Alan Greenspan said about M1). Further, the emphasis on monetary aggregates as policy targets has decreased. In addition, respondent participation has declined over the last several years. For these reasons, the Federal Reserve proposes to discontinue the survey and the related statistical release.”

Spencer

Feb 3 2023 at 3:03pm

Divisia aggregates rate of change has turned negative for the first time since the GFC.

CFS Monetary Measures for December 2022 | News and Views (centerforfinancialstability.org)

Henri Hein

Feb 3 2023 at 3:56pm

Reminds me of the saying:

nobody.really

Feb 4 2023 at 12:25am

Which means it’s … easy?

For what it’s worth, Ngram indicates that the expression “shooting fish in a barrel” dates from about 1907, and has grown in popularity until peaking in 2013–whereas the expression “shooting ducks in a barrel” dates from around 1940, and has remained obscure ever since.

Jose Pablo

Feb 6 2023 at 4:31pm

Wouldn’t there be more people out shopping if the population increased? Yes, but each person would possess fewer silver coins

Yes, but M x V is not the same as M, right?

I always have problems thinking about the effect of any particular shock on “V”.

didn’t kill silver coins

Yeah, right, but that is M. What was the effect of the Black Death on V?

Comments are closed.